Not sure what a jumbo mortgage really is or why it matters? In this quick video, I break down the key differences between jumbo and conforming loans—and what it could mean for your homebuying journey. Don’t miss these insider tips that could save you time, money, and stress!

Category: First-Time Homebuyer

Navigating the Competitive Spring Housing Market in Portland

https://youtube.com/shorts/UCmsNheSkG8

Just yesterday the front page of our local paper highlighted the challenges buyers face in this competitive spring market. If you’re a home buyer, watch this short video for practical steps to achieve the best outcomes:

- Be Proactive with Home Loan Financing: Start with a thorough pre-approval. Submit all supporting income and asset documents to get fully pre-approved.

- Understand Your Affordability: Know your budget. You might need to offer above list price, so understand how this impacts your payments, closing costs, and cash needed for closing. Work with a lender who explains these options clearly.

- Evaluate Contingencies: Consider waiving the appraisal contingency or qualifying for a cash guarantee program.

Want to learn more about your options to win in this marketplace? Contact us today!

Real Talk Ep 15 with David Battany: Unlocking Homeownership

Welcome to another episode of the Real Talk video podcast series! In this episode, we are thrilled to interview mortgage industry veteran and capital markets expert, David Battany. With over 30 years of experience as a leader in the field, David shares his invaluable insights on the significance of homeownership in our society. Join us as David demystifies the true determinants of mortgage rates and provides expert advice on when consumers should consider locking in a rate.

His profound understanding and passion for the industry make this episode a must-watch for anyone interested in the mortgage market. Don’t miss out on this engaging and informative conversation with one of the brightest minds in the field. We’re honored to have David on the show!

Unlocking Homeownership: Family Gifts

Are you a first-time homebuyer in need of down payment funds? Or perhaps you’re a parent or grandparent looking to help your children or grandchildren buy their first home? In this video, we explore tax-efficient strategies to make your dreams a reality!

Join us as we dive into the 2025 IRS Annual Gift Tax Exclusion and Lifetime Exemption amounts. We’ll show you real-life examples of how to structure gifting in a way that avoids triggering gift taxes. Learn how to maximize your financial support without the tax burden.

Don’t miss out on these valuable insights! Watch now to discover how you can help first-time homebuyers achieve their homeownership goals.

Evan-omics: Mortgage Rates, An Insider Perspective of The Fed Mindset, And Home Insurance Tips!

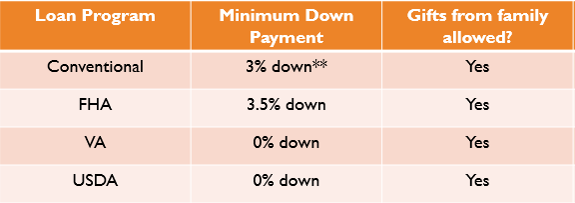

Think you need 20% down? Think again…

I came across an article over the weekend which stated that roughly 40% of US citizens between the ages of 25-34 believe that lenders require at least 15% down payment in order to purchase a home. This may be one reason why those in the “millennial” generation have lagged their predecessors in home-ownership rates (there are certainly other factors). The truth is that there are many programs which allow for less than 5% down and all of them allow the down payment to be 100% gifted by a family member.

Of course all these programs are subject to qualifying and there are some caveats. But, if you or someone you know has been putting off buying a home because they thought they needed to save more money its probably worth exploring options now given that interest rates are very attractive and most analysts believe home prices will continue to rise. I’d love to be a resource for you so don’t hesitate to let me know if you’d like to engage in a conversation about your circumstances.

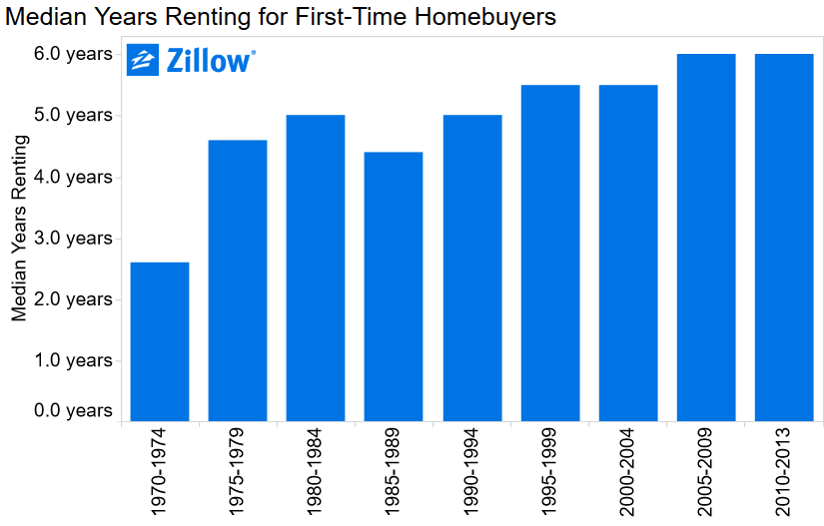

Comparing first-time homebuyers today to yesteryear?

Zillow’s real estate analytics blog released an interesting piece recently focusing on the characteristics of today’s first-time homebuyer. You can read the entire piece HERE. The author looked at a variety of financial and demographic trends of today’s first-time homebuyer and compared them to previous generations. The findings?

A summary:

- First-time homebuyers are older today and spend more time renting that previous generations.

- First-time homebuyers are less likely to be married today than previous generations and increasingly purchase condo’s instead of single family homes.

- Today’s first-time homebuyers have lower credit scores and down payments than previous generations.

The fact that homes are more expensive today relative to household income is likely influencing the findings. How does your experience as a first-time homebuyer differ from your parents generation? Please comment below.

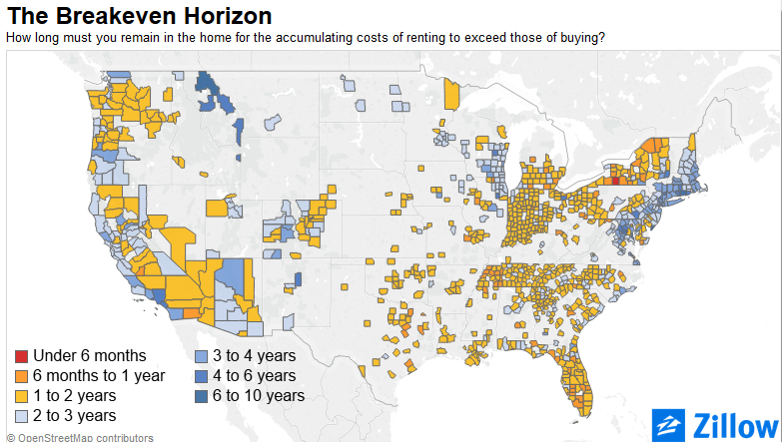

Rent vs. Buy break-even

During my initial call with a new customer who is interested in purchasing their first home I like to ask what their motivation is for buying. Their answers can provide valuable insights in understanding what is ultimately important about their decision making process. As you might imagine, most of the customers I have spoken with over the past year have indicated that they are tired of paying ever higher rents to their landlord.

With rents increasing so significantly in our marketplace the monthly payments associated with owning a home look ever more attractive. But for some the nature of their employment or other factors may not keep them in a home long-term. Inevitably the decision to purchase or rent is looked at through a financial lens. Does it make sense to buy or continue to rent?

Zillow maintains an ongoing “break-even horizon” for housing markets across the country which measures the financial break-even between owning and renting. The analysis takes into account inflation, property taxes, tax benefits, home appreciation, rental appreciation, and opportunity costs. You can read the complete methodology HERE.

According to this analysis Zillow estimates the current “break-even” at 2.1 years for the Portland market. In other words, a home buyer would need to keep the home for at least 2 years and 2 months in order break-even financially as compared to renting. Beyond that they should come out ahead assuming Zillow’s assumptions prove accurate which is never a guarantee.

Grant Program to be eliminated

Back in 2014 the National Homebuyer Fund (www.nhfloan.org) made buying a home with 0% down possible again by arranging down payment grants to qualifying buyers. I wrote about the program HERE.

It was announced yesterday that this grant program would be suspended as of February 29, 2016. Homebuyers utilizing the grant program can close after February 29, 2016 but reservations and locks must be received no later than that date.

It remains to be sen if another entity will come in ad fill this void.

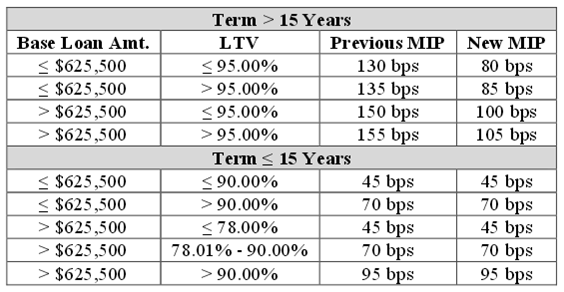

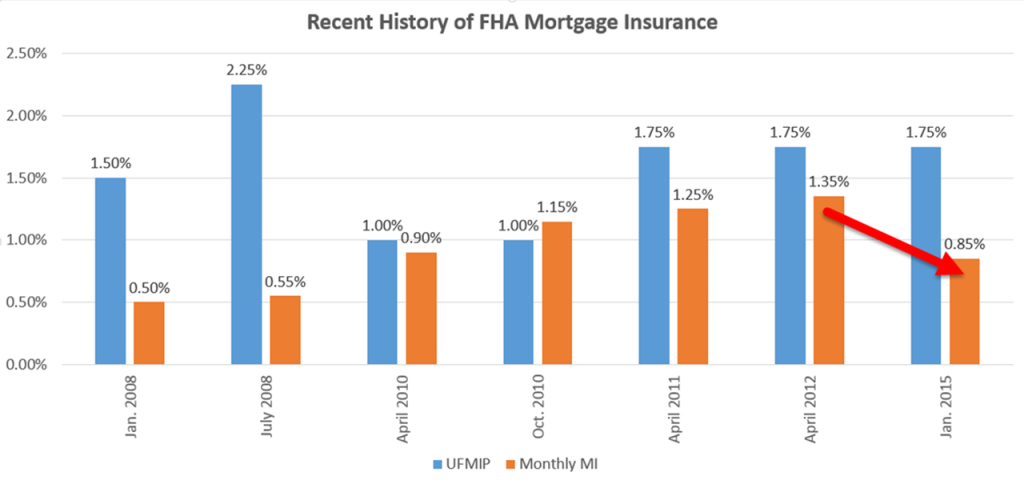

FHA adjusts mortgage insurance again

Finally, some good news for FHA loan applicants. Since January 2008 FHA steadily raised FHA Mortgage insurance premiums to help make up for steep losses incurred as a result of the housing bust. Apparently the FHA mortgage insurance pool is back on healthier footing because as of yesterday FHA mortgage insurance premiums are actually declining! HERE IS A LINK to the mortgagee letter announcing the reduction. And here is a recent history of FHA Mortgage insurance premiums:

Here is the chart showing updated FHA mortgage insurance premiums as of yesterday: