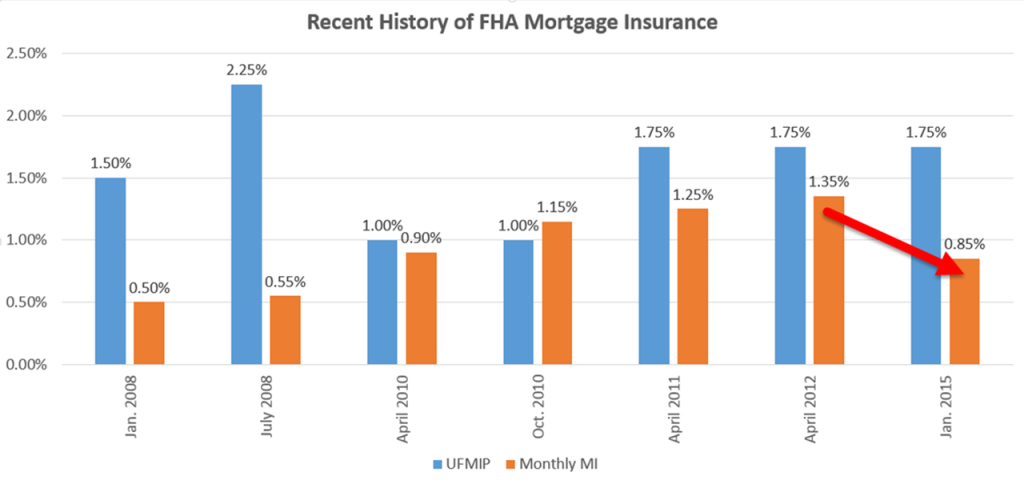

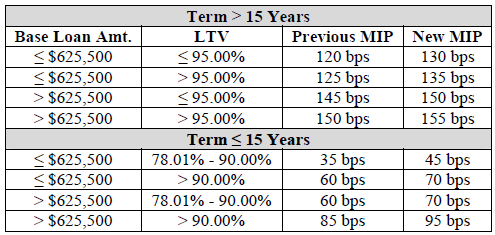

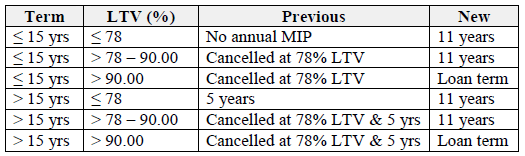

The Department of Housing and Urban Development released THIS STATEMENT last week announcing upcoming changes to the popular FHA loan program. The changes will take effect September 7th October 4th and are designed to increase mortgage insurance revenue to help stabilize the FHA insurance pool which makes FHA loans possible. Effectively, HUD is decreasing the upfront mortgage insurance premiums (currently 2.25%) by 125 basis points (1.00%) but increasing the monthly mortgage insurance by 35 basis points (from .50-.55% to .85%-.90%). The change will increase monthly payments and decrease affordability. Here is the impact per $100,000 in loan amount:

Current MI arrangement for >95% loan-to-value per $100,000

Loan Amount: $100,000

Upfront Mortgage Insurance Premium (2.25%): $2,250

Total Loan Amount: $102,250

Monthly Mortgage Insurance Premium (.55%): $45.83

Monthly Principal & Interest + Mortgage Insurance @ 4.50%: $563.92 (does not include property taxes or homeowner’s insurance)

New MI arrangement for >95% loan-to-value per $100,000 as of September 7 October 4th, 2010

Loan Amount: $100,000

Upfront Mortgage Insurance Premium (1.00%): $1,000

Total Loan Amount: $101,000

Monthly Mortgage Insurance Premium (.90%): $75.00

Monthly Principal & Interest + Mortgage Insurance @ 4.50%: $586.75 (an increase of 4.05%-does not include property taxes or homeowner’s insurance)

See the spreadsheet HERE.