Category: Mortgage Insurance

FHA mortgage insurance changes coming

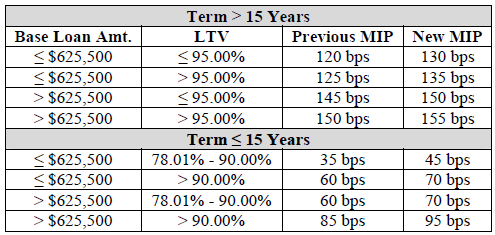

The FHA is extending their efforts yet again to make their loans comparatively more expensive to conventional financing and private mortgage insurance. In their mortgagee letter released on January 31st (see HERE) they announced that for FHA mortgage applications registered after March 31st the monthly mortgage insurance premiums will increase. It’s important to emphasize that these changes only impact new FHA mortgage originations and will not change the mortgage insurance requirements for existing FHA loans. Here the chart featured in the release which shows the changes:

For a $250,000 purchase where a customer is putting the minimum 3.5% down payment this creates an additional monthly expense of about $20 per month.

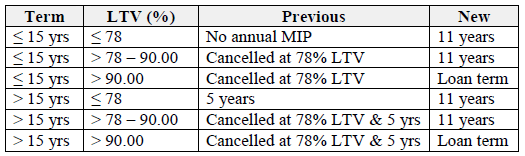

The second change they announced in the letter concerns the duration for which FHA monthly mortgage insurance premiums have to be paid and doesn’t take effect until June 3, 2013. Under the current rules 30-year fixed rate FHA borrowers who put less than 10% down are required to pay their monthly mortgage insurance for at least 5 years. After 5 years they can have the monthly mortgage insurance payments eliminated once their loan balance reaches 78% of the original purchase price (or appraised value if original FHA loan was a refinance). Under the new rules FHA borrowers will be required to pay monthly mortgage insurance for the entire term of the loan.

Collectively these changes will create added incentive for homebuyers to seek non-FHA forms of lending such as conventional financing with lender paid mortgage insurance. However, conventional loans have additional layers of underwriting requirements making them more difficult to obtain. Borrowers who have to rely on FHA financing will likely want to look for ways to fast track their finances so they can replace their FHA loan with a conventional mortgage after a couple years.

Higher FHA premiums on the horizon

The Mortgage Banker’s Association is reporting that the FHA Reform Act of 2010 passed the US House of Representatives. This bill was drawn up in response to many of the solvency issues that the FHA began encountering late last year (see HERE). One of the most aggressive provisions of the bill is that it will allow the FHA to charge up to 1.55% in annual mortgage insurance premiums. This is up from the current maximum of .55%. How does this translate into dollars?

Currently, for a homebuyer that buys a home for $250,000 and puts the minimum 3.5% down that is required by FHA financing their monthly mortgage insurance premiums are $110.57. Their total principal, interest, property taxes, homeowner’s insurance, and mortgage insurance (PITI) is about $1,737.

With the proposed mortgage insurance the same homebuyer would have monthly mortgage insurance premiums of $311.61 (181% increase). Their projected PITI payment would be $1,938 (11.6% increase).

The bill has yet to become law but I suspect that it will. It’s unclear at this point how quickly the new provisions would be put in place. I’m curious to know how happy the private mortgage insurers are about this. The increase of mortgage insurance premiums should generate a lot more business for them.

Your Guide to Understanding Mortgage Insurance

When a home buyer takes out a new mortgage and has less than 20% down often times they will be required to provide mortgage insurance to the lender (exceptions exist when we’re able to provide “combination loans” which are fairly uncommon these days).

Mortgage Insurance (also known as “mi” or “pmi‘) is insurance which covers the lender against a portion of their losses should the loan they make result in payment delinquency or foreclosure.

There are various forms of mortgage insurance which home buyers should be aware of. Here is a brief explanation of each:

Borrower-paid mortgage insurance (BPMI)– This is the most common form of mortgage insurance. The insurance premiums for this form are paid for by the borrower on a monthly basis and varies depending on the loan amount, loan-to-value, and credit score of the borrower. With this form of mortgage insurance the borrower can often request that the mortgage insurance payment be removed from their monthly payment once they have established a 24-month clean payment record and can demonstrate that they have 20% equity in the property. However, it’s important to note that the only legal requirement the lender has to eliminate the mortgage insurance is under the Homebuyers Protection Act which states that the lender is not required to eliminate the mortgage insurance until the loan balance is scheduled to reach 80% of the original purchase price based on the original amortization schedule.

Lender-paid mortgage insurance (LPMI or “No mi”)– With this form of mortgage insurance the borrower accepts a modestly higher interest rate in exchange for not having to make a monthly mortgage insurance payment. Often times these plans create the lowest possible monthly payment and can be most tax efficient. The drawback of LPMI is that the increase a borrower accepts to their interest rate is permanent so even when they have achieved 20% equity in their home their rate will remained at the higher level.

One-time or “upfront” mortgage insurance– With this form of mortgage insurance the borrower makes a one-time mortgage insurance payment at the outset of taking the loan and then does not have to make any additional mortgage insurance payments for the duration of the loan. This option works best for a home buyer who is seeking to create the lowest possible monthly payment and has enough money to cover the additional settlement charges (but not enough to put 20% down).

Split mortgage insurance– Split mortgage insurance combines aspects of the BPMI & the one-time mortgage insurance forms. With a split mortgage insurance structure the borrower pays an upfront or “one-time” mortgage insurance payment at closing & accepts a monthly BPMI payment as well. The most common form of this is with the FHA program. With a FHA loan the buyer finances an upfront mortgage insurance premium into the loan amount and makes a monthly mortgage insurance payment. These two amounts are less than if the borrower did the BPMI or one-time mortgage insurance exclusively.

Rate Update Feb 27, 2008

You Tube link to see rate update video: http://www.youtube.com/watch?v=uhh_BCCeazg

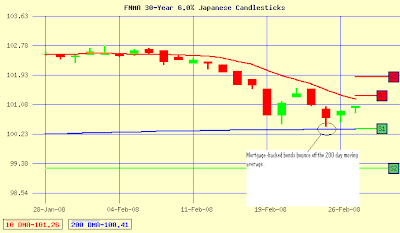

After moving higher yesterday morning mortgage rates appear to have reversed course on technical trading patterns and testimony from Ben Bernanke.

Mortgage-backed bond prices touched the 200-day moving average yesterday morning and despite worse than expected inflation data that would ordinarily weigh on bond prices were able to reverse higher (see chart above).

Today, Fed Chairman Ben Bernanke is testifying in front of Congress on the outlook of the economy. Watch today’s you tube video to hear which comment is helping mortgage rates move lower.

Current Outlook: floating