Category: The Fed

Mortgage Rate Update December 7, 2015

Housekeeping note: ‘Rate update’ will be on vacation (and hopefully on a golf course) this Thursday. You can expect it to return one week from today.

Mortgage rates are unchanged from last Thursday.

We are now only 9 days from the Fed’s next announcement regarding US monetary policy. The financial markets have priced an ~80% probability that the Fed will hike short-term interest rates at this next meeting.

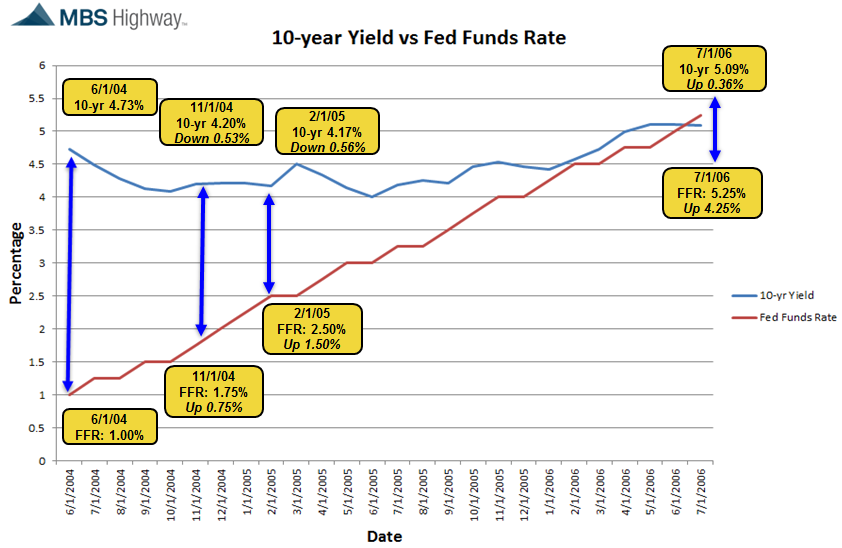

As I have stated numerous times on this blog a Fed rate hike does not necessarily mean that mortgage rates will immediately increase. My friends over at mbshighway.com put together a great graph showing how mortgage rates reacted to the last tightening cycle which took place from June 2004 until July of 2006.

As you can see mortgage rates actually initially declined and then held mostly stable over the duration of this period. How is this possible? When the Fed raises short-term interest rates their objective is to curb inflationary pressure in our economy. Inflation is the nemesis of mortgage rates. Therefore, as the Fed hikes rates they concurrently curb inflationary expectations which is positive for long-term interest rates, including mortgages.

The economic calendar is relatively light this week. We can start the week by floating.

Current Outlook: floating

Mortgage Rate Update September 14, 2015

Mortgage rates are more or less unchanged from last week.

Although there is nothing of significance being released today the rest of the week brings very significant economic data. On Tuesday we’ll get a read on retails sales and industrial production.

On Wednesday, we’ll get the latest reading on the Consumer Price Index (CPI). As I’ve written about extensively on this blog inflationary pressure is the last thing the Fed is waiting on before they start raising short-term interest rates.

And speaking of the Fed, the major highlight of the week comes Thursday when they will release their latest monetary policy decision. At this point it appears unlikely that the Fed will raise short-term interest rates at this meeting. Let’s not forget that the Fed DOES NOT directly control mortgage rates. Yet what they say and how they say it can influence the direction of longer-term interest rates.

I anticipate that the markets will trade sideways until Thursday and then we could see some volatility depending on what they elect to do. I will remain in a floating stance.

Current Outlook: floating

Bernanke comments are pressuring rates higher

Fed Chairman Bernanke’s comments on Capitol Hill earlier today are weighing on interest rates today. He mentioned that the Fed may begin to wind down quantitative easing (QE) at one of its “next few meetings”. QE pumps $85 billion per month into the bond market which drives yields on US Treasuries and mortgage rates lower. US Treasury yields and mortgage rates tend to move in unison. The chart below shows the 10-year treasury yield jumping ~.125% today so we’d expect mortgage rates to do the same.

The history of QE

A guy named Michael Snyder posted this slightly comical/ slightly- dooms-day account of the history of quantitative easing & American monetary policy over the past 30 years. I don’t believe in the outcomes that Michael eludes to in this article but never the less it is an interesting read. It is a little disturbing to look at the 30 year trends of short-term interest rates & government spending.

Bernanke indicates further easing is likely

You may recall that I blogged THIS POST at the end of September in which I indicated that lower mortgage rates would be dependent on HOW MUCH the Fed would engage in quantitative easing. The WSJ reported today (see HERE) that Fed Chairman Ben Bernanke stated in a speech today that he believes “additional purchases have the ability to ease financial conditions”. It sounds like it is pretty much a forgone conclusion that the Fed will be buying up more Treasury debt later this year with the idea of driving down long-term interest rates. However, the markets have already priced Fed action into current rates. The question is no longer “If?” the question is “How much? How far? and How quickly?” will the Fed take action. A report today suggested that based on the current level of interest rates the markets are pricing in Fed action of between $315 billion- $670 billion.

If this report is right then we can assume that Fed action at the high end or above this range will cause mortgage rates to dip even more & a number at the lower end or below this range will likely cause rates to reverse higher.

Rates moving lower is dependent on Fed

Last week in their monetary policy statement the Fed acknowledged that they were concerned about the strength of the economic recovery and that they stood by ready to act to stimulate the economy if needed. Given that short-term interest rates are already close to 0% their traditional mechanism for steering the economy has already been deployed. Therefore, the markets are assuming that they will in engage in further quantitative easing through the purchase of US Treasury securities including notes and bonds. The impact of this action is to drive long-term interest rates lower which should also help mortgage rates.

Following the Fed’s announcement last week rates did dip in anticipation of future easing. The 10-year Treasury note yield dipped to around 2.50% from 2.75% earlier in the week (mortgage rates only benefited by about .125%).

Following the Fed’s announcement last week rates did dip in anticipation of future easing. The 10-year Treasury note yield dipped to around 2.50% from 2.75% earlier in the week (mortgage rates only benefited by about .125%).

However, it’s important to note that the Fed has yet to commit to any action. They’ve only stated that they stand by ready to act if needed. In this morning’s WSJ Jon Hilsenrath reports that the Fed is more likely to take smaller-scale and more gradual approach to quantitative easing than their last action in 2009. If he’s right it will be interesting to see how interest rates react.

For now interest rate analysts will be closely watching the economic data that is released from now until the Fed’s next monetary policy meeting at the beginning of November. If the economic data is grim it will strengthen the case for further quantitative easing on the part of the Fed and rates will benefit. If it’s stronger than expected the Fed will be more likely to forgo any more stimulus which will hurt rates.

Fed’s statement suggests higher mortgage rates

As expected the Fed announced today that they would leave short-term interest rates near historic lows. No surprises there. However, there was a couple interesting excerpts from their post-policy meeting statement which suggest mortgage rates are poised to move higher (also not a surprise if you’ve followed my blog posts time and time again).

Here is a link to the full statement & here are the highlights:

*The Fed’s view is a little rosier: Since April the Fed has continually stated that economic activity would be “weak for a time.” Today, they changed the wording to state economic activity would be “moderate for a time.” The change in wording is sign that they believe the economy is improving. Good news for the economy is bad news for mortgage rates.

*The Fed will stop buying mortgage-backed bonds (MBS’s): As I wrote about in my November newsletter as soon as the Fed announced that they would begin buying MBS’s in November of 2008 rates nose dived. The Fed has been very transparent in communicating that they would discontinue this program at the end of the first quarter and they reiterated that today by stating “on March 31, the Fed will complete its purchases of $1.25 trillion of mortgage-backed securities.” They go on to say “Fed officials believe mortgage rates could rise when it stops its purchases, but most believe it will be less than half a percentage point and possibly less.” and possibly more. They did leave the door open to change their minds regarding this policy.

All in all the statement is reassuring from the standpoint that the Fed seems to be confident the economy is improving which means more jobs!!!!!! The drawback is that we know that when the economy improves and the government unwinds their stimulus efforts mortgage rates will move higher.

Summary of the Fed’s current involvement in the US economy

I was emailed this article by a friend. In it the author, who alleges to be a former investment banker, “spins” the Federal Reserve’s current involvement in the US economy to lead readers into believing that we’re currently witnessing one of the largest financial conspiracy theory’s in modern history.

I had planned to respond to his email privately and then figured I might as well use it as an opportunity to blog about my understanding of the financial system and to clarify how the Fed is currently using their tools to stimulate the economy.

So here we go from the top:

*What is the Fed responsible for?

Their job is threefold- 1) maintain price stability (i.e. low inflation) 2) promote full employment & 3) sustain economic growth.

*How do they go about doing this?

They effectively have three tools- 1) Federal funds rate (impacts short-term interest rates) 2) Open Market Operations (buy/ sell securities) & 3) Margin requirements (sets level at which investors can leverage security purchases)

*Currently, what is the Fed most concerned with?

Under the current economic environment the Fed’s main concerns are improving employment & economic growth. Inflationary pressures are not a concern at the current time.

*How are they going about improving employment and economic growth?

They are using two primary strategies right now. First, they have cut the Federal Funds Target Rate down to 0-.25%. As a result short-term interest rates on lines of credit and revolving credit are very low which they hope will stimulate businesses to borrow money to invest in their companies and to entice consumers to borrow money to spend on consumer goods.

Second, they are engaging in open market operations. This is when they purchase securities from the open market. It helps to stimulate the economy because they exchange money for securities. The money increases the supply of money in the economy and drives down interest rates by creating additional demand for these securities and by increasing the supply of money in the economy. The most well known operation that the Fed is currently engaged in is the TALF program which I blogged about last November. It was later expanded and can be credited for keeping mortgage rates near historic lows throughout 2009.

Each of these initiatives are designed to increase liquidity in the economy, which drives interest rates lower, and increases investment and consumption.

*Has the Fed been secretive in their initiatives?

Far from a conspiracy the Fed has been more than transparent in their action. The TALF made headlines news when it was announced and in last week’s monetary policy meeting the Fed clearly announced that they had already discontinued the purchase of US Treasury securities and would discontinue the purchase of mortgage-back bonds early in 2010. This is not a secret.

*As the author addresses in the article, how are their actions going to impact security prices?

When the Fed engages in open market operations they create substantial demand for the fixed-income securities that they are buying. As a result, the value of the asset increases and the yield decreases (which is how bonds work). Therefore, when the Fed leaves the market when their open market operations are discontinued it is likely that interest rates will move higher which will in turn push the value of existing fixed-income securities lower.

Because fixed-income securities with low coupons are more volatile than securities with higher coupons (all else being equal) we do expect these securities to take a hit. But is this really detrimental to the “small investor” as the author suggest?

I would argue no. First off, keep in mind that if the “small investor” was buying fixed-income securities during this crisis they probably owned fixed income securities headed into this crisis as well. The values of their holdings rallied as the Fed began their open market operations in late 2008. In fact, mutual funds which hold long US treasury positions were some of the top performers from 2007 to current.

Second, income investors who buy bonds under a buy-and-hold strategy have probably determined that the coupon payments they receive are sufficient to satisfy their cash-flow needs. When rates rise the value of their underlying bond will decrease. But, so long as the coupon is still being paid they shouldn’t care because the income will not be impacted.

Lastly, for growth investors who are concerned about capital appreciation the solution is simple right now. Don’t purchase long-term government notes or bonds. Instead, use shorter duration bills and bank products to make up the portion of your portfolio that you hold in fixed income securities. As rates rise, you will then be able to re-invest the principal into higher yielding assets.

*Since the Fed is effectively creating money right now through their open market operations won’t that lead to hyper-inflation later on?

This is one of the most hotly debated topics in financial circles right now. It is true that we find ourselves in a unique situation. The Fed has never been in a position where they’ve created this much money. And as I blogged about a month or so ago, according to Irving Fisher’s Equation of Exchange it is possible that as the economy improves the expanded money supply could lead to significant inflation if the Fed is unable to unwind the liquidity in time.

However, the Fed claims that they have the tools to unwind the money supply in time using tools such as reverse repurchase agreements to prevent rapid inflation. In fact, the Wall Street Journal reported back in October that they were already testing these tools to be sure they were prepared.

In summary, fundamentally the Fed is doing nothing different today than they’ve done in the past. The difference is that they are using their tools on a much larger scale than they’ve employed in the past. As with any action their is a reaction and the Fed will need to be cognizant of the long-term implications their policy decisions have. But for now, I think preventing the economy of falling into a deep recession is their biggest goal.

Rate Update July 21, 2009

Mortgage rates appear poised to move lower this morning. Despite positive earnings reports that have helped stocks to move higher, mortgage-backed bonds have rallied this morning thanks to comments made by Fed Chairman Ben Bernanke.

Watch today’s you tube video for details on what he said.

Click this link to view Fed Chairman Bernanke’s Op-ed piece in this morning’s WSJ.

Current Outlook: floating