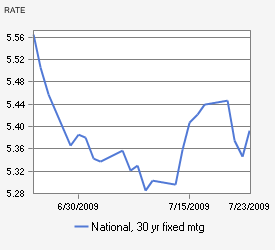

Overall, mortgage rates are unchanged today.

For the second day in a row the economic calendar is empty today. Therefore, we’ll be watching the equity markets & technical trading patterns.

At the open stocks are trading in positive territory thanks to announcements from two different Canadian banks that they be acquiring two US financial institutions. This may be a sign of things to come because the US Dollar is currently trading at decade lows versus foreign currencies. Takeover announcements typically help stocks to trade higher because businesses are usually acquired at a premium to their stock price AND as we know what is good for stocks is often bad for mortgage rates.

The technical trading picture for mortgage-backed bonds is fairly neutral. The Fed will be buying up more treasuries today which is a good for mortgage rates. I will shift to a neutral position for now.

Current outlook: neutral