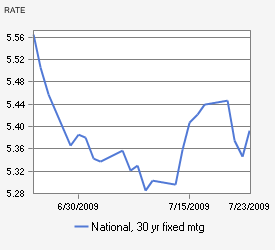

Mortgage note rates are mostly unchanged to start the week but the accompanying closing costs are modestly lower.

Geopolitical tension is helping to keep mortgage rates low here in the US. Fighting in Gaza City escalated over the weekend between Israel and Hamas.

Moreover the political unrest between Ukraine and Russia also escalated over the weekend as each side blamed the other for the downing of an aircraft last Thursday.

Global political uncertainty benefits US interest rates because investors seek “safe” alternatives for capital. As a result, demand for US dollar-denominated securities goes up which helps keep yields low.

The economic calendar is relatively dense this week. There are not a lot of reports due out but those that are scheduled for release are significant. Tomorrow we’ll get the latest reading for the Consumer Price Index. Ordinarily inflation is the primary driver of interest rates and we have seen price pressure pick up in the past couple months.

From a technical perspective mortgage rates look attractive right now so its tough not to lock. However, momentum is on our side so I will recommend a floating position for now. But, be prepared to lock.

Current Outlook: floating