FHA mortgage insurance changes coming

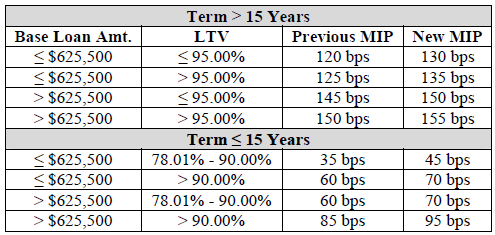

The FHA is extending their efforts yet again to make their loans comparatively more expensive to conventional financing and private mortgage insurance. In their mortgagee letter released on January 31st (see HERE) they announced that for FHA mortgage applications registered after March 31st the monthly mortgage insurance premiums will increase. It’s important to emphasize that these changes only impact new FHA mortgage originations and will not change the mortgage insurance requirements for existing FHA loans. Here the chart featured in the release which shows the changes:

For a $250,000 purchase where a customer is putting the minimum 3.5% down payment this creates an additional monthly expense of about $20 per month.

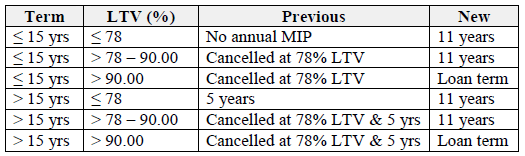

The second change they announced in the letter concerns the duration for which FHA monthly mortgage insurance premiums have to be paid and doesn’t take effect until June 3, 2013. Under the current rules 30-year fixed rate FHA borrowers who put less than 10% down are required to pay their monthly mortgage insurance for at least 5 years. After 5 years they can have the monthly mortgage insurance payments eliminated once their loan balance reaches 78% of the original purchase price (or appraised value if original FHA loan was a refinance). Under the new rules FHA borrowers will be required to pay monthly mortgage insurance for the entire term of the loan.

Collectively these changes will create added incentive for homebuyers to seek non-FHA forms of lending such as conventional financing with lender paid mortgage insurance. However, conventional loans have additional layers of underwriting requirements making them more difficult to obtain. Borrowers who have to rely on FHA financing will likely want to look for ways to fast track their finances so they can replace their FHA loan with a conventional mortgage after a couple years.