Congress approved an appropriations bill that amongst other things restores the FHA loan limits that have been in place the past 2 years and extends them through 2013. For the Portland-Metro area this means the maximum FHA loan amount goes back to $417,000. If you’d like to check another location you can do so at THIS LINK.

Category: First-Time Homebuyer

FHA loan limits decrease as of October 1st, 2011

Sorry for the late post on this topic. As of October 1st, 2011 FHA loan limits for most areas of the country have declined as a result of expiration of stimulus legislation. Currently, the FHA loan limit for a single family residence in the Tri-county area (Portland, OR) is $362,250. This figure can adjust as of Janaury 1st, 2012 but barring any new legislation I wouldn’t expect it to. You can use THIS LINK to check the FHA loan limits for other areas.

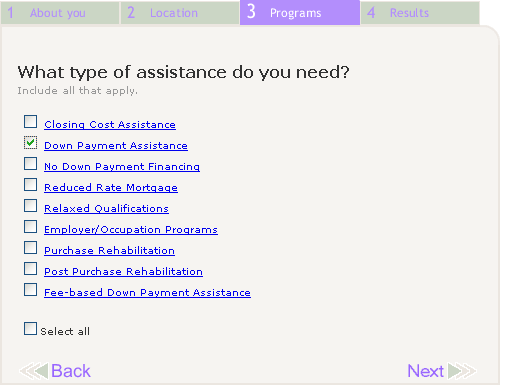

Are you looking for homebuyer assistance in PDX-Metro area?

In my interactions with first-time homebuyers I am often asked about special assistance programs that may be available for them. I recently came across the HOMEOWNERSHIP OPPORTUNITIES WEBSITE NORTHWEST which provides a search tool where you can plug in information about yourself and see what programs might be available to you. It’s an easy way to do research on the various types of programs that are available.

Prudent advice for aspiring 1st time home-buyers

The financial blog couplemoney.com gave very prudent advice in THIS POST for aspiring 1st-time home-buyers. They recommend taking a breath before jumping into a house and making sure that the home-buyer is both financially and emotionally ready for this level of commitment. What I also love about the post is that they recommend a home-buyer take into account their other financial goals (i.e. retirement, debt reduction, etc.) before committing to a house because “lenders and real estate agents don’t figure this into their calculations.” This is exactly why I chose to pursue the CERTIFIED FINANCIAL PLANNER™ designation: so I can help applicants take these other objectives into account. Here is good excerpt from the post:

The financial blog couplemoney.com gave very prudent advice in THIS POST for aspiring 1st-time home-buyers. They recommend taking a breath before jumping into a house and making sure that the home-buyer is both financially and emotionally ready for this level of commitment. What I also love about the post is that they recommend a home-buyer take into account their other financial goals (i.e. retirement, debt reduction, etc.) before committing to a house because “lenders and real estate agents don’t figure this into their calculations.” This is exactly why I chose to pursue the CERTIFIED FINANCIAL PLANNER™ designation: so I can help applicants take these other objectives into account. Here is good excerpt from the post:

*“I will say up front that I don’t think home ownership isn’t for everyone. If you’re not willing to put in the legwork and run the numbers, it can be a huge financial and emotional burden. If you’re really intent on buying a home, taking the time to get a financial plan in order can be a huge step in helping you reach your goal. It can also provide you a way to make home ownership a relatively enjoyable experience.”

FHA mortgage insurance premiums on the rise…again

You may remember that HUD increased monthly mortgage insurance premiums on FHA loans last year in an effort to shore up finances for the FHA insurance poll. Unfortunately, HUD is at it again. Beginning with FHA case numbers assigned after April 17, 2011 monthly mortgage insurance premiums will be going up .25% for 30 year mortgages and .50% for 15 year mortgages. HERE is a link to download the mortgagee letter in case you want to read the news directly from the source.

What does this mean for homebuyers? It means monthly payments will rise. On a hypothetical purchase of a home for $215,000 the total monthly “PITI+MI” payment would increase from $1,509 to $1,552; an increase of $43 per month.

To avoid this change homebuyers would have to be in contract to buy a home a couple days before April 17th so that the lender could register the loan with HUD prior to the change. The upfront mortgage insurance premium that gets financed into the loan amount would remain unchanged at 1.00%.

Mortgage Loan Limits: FHA & Conforming

In case you want to find a FHA or conforming loan limit for a specific area around the country you can use THIS HANDY WEBSITE from HUD.gov.

HUD announces increase to mortgage insurance for FHA loans

The Department of Housing and Urban Development released THIS STATEMENT last week announcing upcoming changes to the popular FHA loan program. The changes will take effect September 7th October 4th and are designed to increase mortgage insurance revenue to help stabilize the FHA insurance pool which makes FHA loans possible. Effectively, HUD is decreasing the upfront mortgage insurance premiums (currently 2.25%) by 125 basis points (1.00%) but increasing the monthly mortgage insurance by 35 basis points (from .50-.55% to .85%-.90%). The change will increase monthly payments and decrease affordability. Here is the impact per $100,000 in loan amount:

Current MI arrangement for >95% loan-to-value per $100,000

Loan Amount: $100,000

Upfront Mortgage Insurance Premium (2.25%): $2,250

Total Loan Amount: $102,250

Monthly Mortgage Insurance Premium (.55%): $45.83

Monthly Principal & Interest + Mortgage Insurance @ 4.50%: $563.92 (does not include property taxes or homeowner’s insurance)

New MI arrangement for >95% loan-to-value per $100,000 as of September 7 October 4th, 2010

Loan Amount: $100,000

Upfront Mortgage Insurance Premium (1.00%): $1,000

Total Loan Amount: $101,000

Monthly Mortgage Insurance Premium (.90%): $75.00

Monthly Principal & Interest + Mortgage Insurance @ 4.50%: $586.75 (an increase of 4.05%-does not include property taxes or homeowner’s insurance)

See the spreadsheet HERE.

Close date for homebuyer credit is extended

Homebuyers with bad lenders just got a break. Congress has passed an extension provision to the popular homebuyer credit. Now homebuyers who qualify under the other rules (including going into contract by April 20, 2010) have until the end of September to close.

Higher FHA premiums on the horizon

The Mortgage Banker’s Association is reporting that the FHA Reform Act of 2010 passed the US House of Representatives. This bill was drawn up in response to many of the solvency issues that the FHA began encountering late last year (see HERE). One of the most aggressive provisions of the bill is that it will allow the FHA to charge up to 1.55% in annual mortgage insurance premiums. This is up from the current maximum of .55%. How does this translate into dollars?

Currently, for a homebuyer that buys a home for $250,000 and puts the minimum 3.5% down that is required by FHA financing their monthly mortgage insurance premiums are $110.57. Their total principal, interest, property taxes, homeowner’s insurance, and mortgage insurance (PITI) is about $1,737.

With the proposed mortgage insurance the same homebuyer would have monthly mortgage insurance premiums of $311.61 (181% increase). Their projected PITI payment would be $1,938 (11.6% increase).

The bill has yet to become law but I suspect that it will. It’s unclear at this point how quickly the new provisions would be put in place. I’m curious to know how happy the private mortgage insurers are about this. The increase of mortgage insurance premiums should generate a lot more business for them.

Using retirement funds for down payment

For many people saving for a rainy day is hard enough as it is. Add on top of that all the other financial objectives a person is typically concerned with (i.e. retirement, college savings, paying down debt) saving for a down payment on a home can be difficult. Because of this I often have clients who are interested in accessing funds in their retirement accounts to come up with money for a down payment. In order to do this it’s important that homebuyers be educated on their options. Therefore, I have put together this post to summarize the important points of using 401K, IRA, and Roth IRA funds towards the purchase of a home.

One quick note that is generally applicable to all three sources. Typically funds derived from a retirement plan used towards the purchase of a home may only be used as a down payment and “usual or reasonable settlement costs” and may not be used to pay other debts in order to qualify for a new mortgage.

401K

Rules for each 401K plan are slightly different so homebuyers need to talk with their plan administrators to make sure they can use their 401K. Technically, a person cannot generally withdraw money from their 401K to use towards the purchase of a home. Instead most 401K plans will allow participants to borrow money from their 401K and pay it back with payroll deductions. For funds being used to purchase a home the repayment period can be longer than the normal required period of 5 years but check with the plan administrator to make sure the payments won’t be onerous .

The plan will usually assign an interest rate to the loan but because the participant is paying and receiving the interest the effective cost of borrowing is 0%. However, while the loan is outstanding keep in mind that it is not receiving investment returns so the true cost of tapping into a 401K is the “opportunity cost”. Homebuyers wishing to use their 401Ks should consider the impact this will have on their future ability to retire. Also, keep in mind that repayment of a 401K loan is made with after-tax dollars. Therefore, when that homeowner retires int he future they will effectively pay tax on the loan amount twice (once when they repaid the loan with after-tax dollars and again in retirement when they take a taxable distribution from the account).

Typically the maximum a person can borrow from their 401K is the lesser of $50,000 or 50% of their vested balance. If the vested balance is less than $20,000 then sometimes they can borrow up to the vested balance or $10,000 whichever is greater.

It’s important to note that a person does not have to be a first-time homebuyer to use 401K funds. It’s also important to note that because the homebuyer will pay back the 401K loan with payroll deductions then it is generally not possible to access funds in a 401K with a previous employer. The homebuyer must currently be working for the plan sponsor. This also creates a significant risk because if the employee is terminated during the repayment period on the loan and cannot pay back the remaining balance the amount will be treated as a non-qualified distribution and be subject to ordinary income tax plus a 10% penalty.

Please note that some 401K plans do allow “hardship” withdrawals for participants who qualify as a first-time homebuyer. However, these distributions are taxable so unless cash-flow is a major concern often times a loan will make more sense.

IRA

IRAs are different from 401Ks in that a person is able to take distributions instead of having to take out a loan. The question then becomes whether or not the distribution will be a deemed a “qualified” or “non-qualified” distribution. A “qualified” distribution IS NOT subject to a 10% penalty while a “non-qualified distribution” is subject to a 10% penalty.

In order for a distribution to be qualified the homebuyer must be a first-time homebuyer which the IRS defines as a person who has not owned real estate in the previous 24 months. The $10,000 cap is a lifetime limit so once a person has utilized the $10,000 they may not use it again.

So long as the contributions to the IRA were tax deductible for the homebuyer then the distribution will be taxed as ordinary income. If the distribution does not meet the criteria of being a “qualified” distribution then it will also be subject to a 10% penalty. Since the homebuyer will typically incur income tax liability for an IRA distribution it’s important they account for that when budgeting out their money from the time of distribution to the following April 15th when taxes are due.

Roth IRA

The rules for Roth IRA distributions used towards the purchase of a home are similar to the aforementioned traditional IRA guidelines in that it is only available for those who meet the IRS’s definition of a first-time homebuyer and is only available up to $10,000. However, there are a couple key differences.

One key difference is that for a distribution to be “qualified” it may not be made inside a 5-taxable-year period which begins January 1st of the taxable year for which the very first contribution was made to any Roth IRA the homebuyer owns. In other words, for a first-time homebuyer who wishes to take a “qualified” distribution from their Roth IRA account anytime in 2010 must have made their very first Roth IRA contribution (to any Roth account) no later than the 2005 tax year.

The other key difference is taxation. Because Roth IRA contributions are not tax deductible at the time of contribution “qualified” distributions are not treated as taxable income. However, if the distribution is not deemed to be “qualified” then it will be subject to a 10% penalty and depending on the contributions made and distribution taken may also have income tax implications.

I hope this summary enables homebuyers out there to make better decisions with their money. Please remember that I am not a tax professional and tax code is subject to change. It is best to discuss your options with a knowledgeable professional when you are close to make such a decision. It is also important to consider the impact that the decision will have on your ability meet your retirement accumulation goals.