Category: First-Time Homebuyer

Think you need 20% down? Think again…

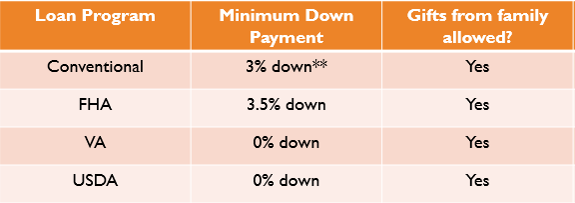

I came across an article over the weekend which stated that roughly 40% of US citizens between the ages of 25-34 believe that lenders require at least 15% down payment in order to purchase a home. This may be one reason why those in the “millennial” generation have lagged their predecessors in home-ownership rates (there are certainly other factors). The truth is that there are many programs which allow for less than 5% down and all of them allow the down payment to be 100% gifted by a family member.

Of course all these programs are subject to qualifying and there are some caveats. But, if you or someone you know has been putting off buying a home because they thought they needed to save more money its probably worth exploring options now given that interest rates are very attractive and most analysts believe home prices will continue to rise. I’d love to be a resource for you so don’t hesitate to let me know if you’d like to engage in a conversation about your circumstances.

Comparing first-time homebuyers today to yesteryear?

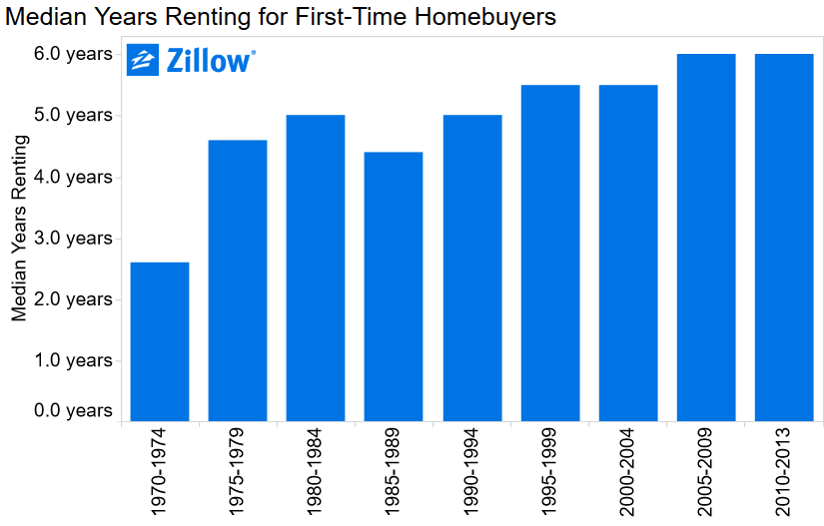

Zillow’s real estate analytics blog released an interesting piece recently focusing on the characteristics of today’s first-time homebuyer. You can read the entire piece HERE. The author looked at a variety of financial and demographic trends of today’s first-time homebuyer and compared them to previous generations. The findings?

A summary:

- First-time homebuyers are older today and spend more time renting that previous generations.

- First-time homebuyers are less likely to be married today than previous generations and increasingly purchase condo’s instead of single family homes.

- Today’s first-time homebuyers have lower credit scores and down payments than previous generations.

The fact that homes are more expensive today relative to household income is likely influencing the findings. How does your experience as a first-time homebuyer differ from your parents generation? Please comment below.

Rent vs. Buy break-even

During my initial call with a new customer who is interested in purchasing their first home I like to ask what their motivation is for buying. Their answers can provide valuable insights in understanding what is ultimately important about their decision making process. As you might imagine, most of the customers I have spoken with over the past year have indicated that they are tired of paying ever higher rents to their landlord.

With rents increasing so significantly in our marketplace the monthly payments associated with owning a home look ever more attractive. But for some the nature of their employment or other factors may not keep them in a home long-term. Inevitably the decision to purchase or rent is looked at through a financial lens. Does it make sense to buy or continue to rent?

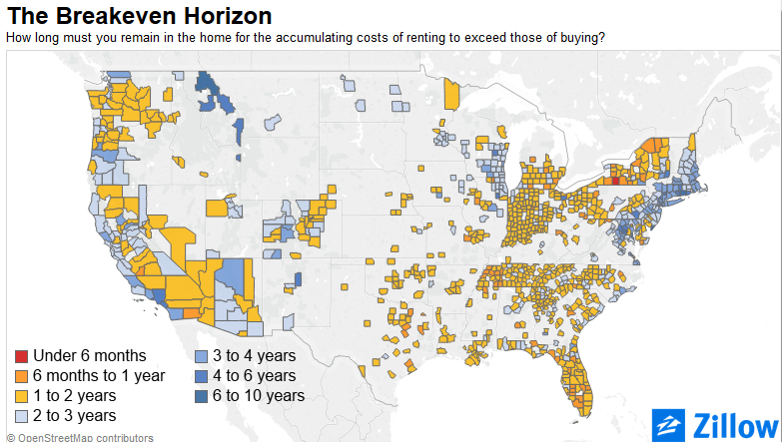

Zillow maintains an ongoing “break-even horizon” for housing markets across the country which measures the financial break-even between owning and renting. The analysis takes into account inflation, property taxes, tax benefits, home appreciation, rental appreciation, and opportunity costs. You can read the complete methodology HERE.

According to this analysis Zillow estimates the current “break-even” at 2.1 years for the Portland market. In other words, a home buyer would need to keep the home for at least 2 years and 2 months in order break-even financially as compared to renting. Beyond that they should come out ahead assuming Zillow’s assumptions prove accurate which is never a guarantee.

Grant Program to be eliminated

Back in 2014 the National Homebuyer Fund (www.nhfloan.org) made buying a home with 0% down possible again by arranging down payment grants to qualifying buyers. I wrote about the program HERE.

It was announced yesterday that this grant program would be suspended as of February 29, 2016. Homebuyers utilizing the grant program can close after February 29, 2016 but reservations and locks must be received no later than that date.

It remains to be sen if another entity will come in ad fill this void.

FHA adjusts mortgage insurance again

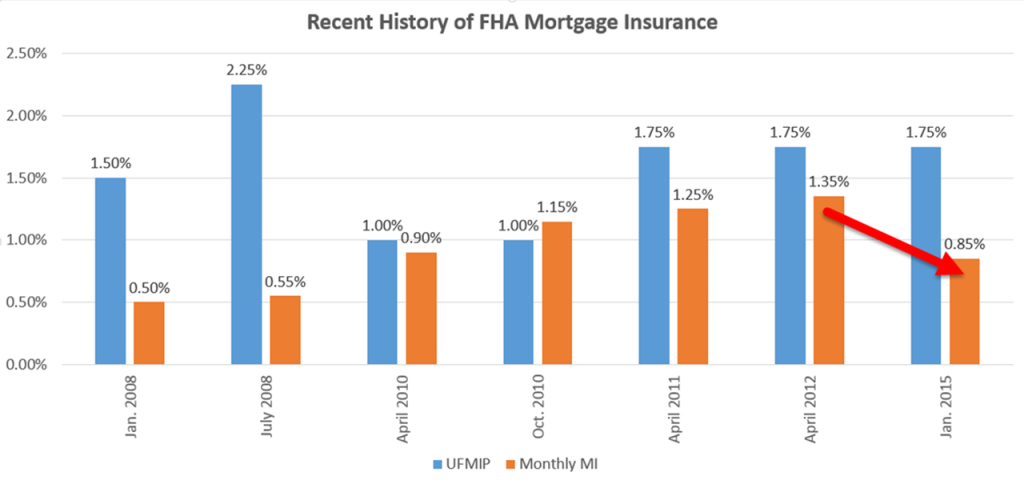

Finally, some good news for FHA loan applicants. Since January 2008 FHA steadily raised FHA Mortgage insurance premiums to help make up for steep losses incurred as a result of the housing bust. Apparently the FHA mortgage insurance pool is back on healthier footing because as of yesterday FHA mortgage insurance premiums are actually declining! HERE IS A LINK to the mortgagee letter announcing the reduction. And here is a recent history of FHA Mortgage insurance premiums:

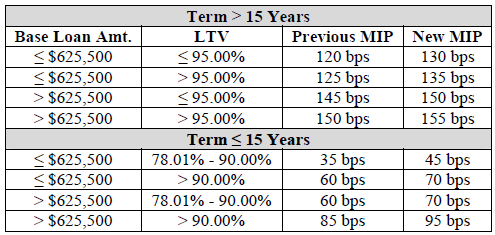

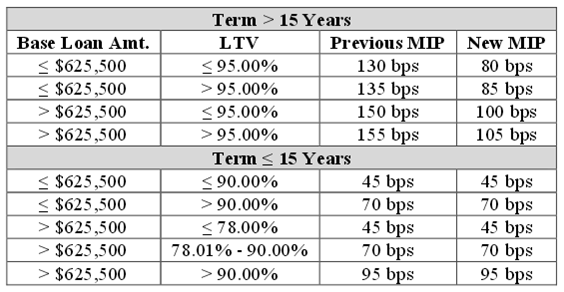

Here is the chart showing updated FHA mortgage insurance premiums as of yesterday:

National Homebuyers Fund Makes 0% Down Purchase Possible Again

For many households, the dream of homeownership has remained elusive because saving for a down payment is financially unrealistic.

As lenders tightened their underwriting standards, following the housing bust over the last decade, most homebuyers have been required to put a minimum of 3.5% to 5% down in order to purchase a home. However, a new grant program is changing the game.

Mortgage Trust, Inc. (NMLS #3250), which Swanson Home Loans is a subsidiary of, is proud to announce that we have become a participating lender for the NHF Platinum™ homebuyer assistance program.

What does this mean for you? Through this program, Mortgage Trust can help eligible families and individuals obtain a grant for a down payment and/or closing costs—a grant that does not need to be repaid.

The National Homebuyers Fund® (NHF) is a nonprofit public benefit corporation that supports affordable, responsible homeownership. NHF manages several Down Payment Assistance (DPA) programs that help people purchase a home with fewer out-of-pocket costs. DPA programs follow standard mortgage loan underwriting guidelines to ensure that borrowers are able to afford their mortgage.

The NHF Platinum™ program is designed to provide down payment assistance on the purchase of a primary residence in various states, including Oregon, Washington, and Idaho.

NHF Platinum™ Program Highlights

- Non-repayable grant, up to 5% of Loan*

- No first-time homebuyer requirement

- Conventional, FHA, VA and USDA Mortgages

- FICO scores as low as 640

*Certain restrictions apply on all programs. Contact Evan Swanson NMLS 120856 to learn more about Borrower Eligibility, Rates, Terms, and Guidelines.

FHA Loan Limits announced for 2014

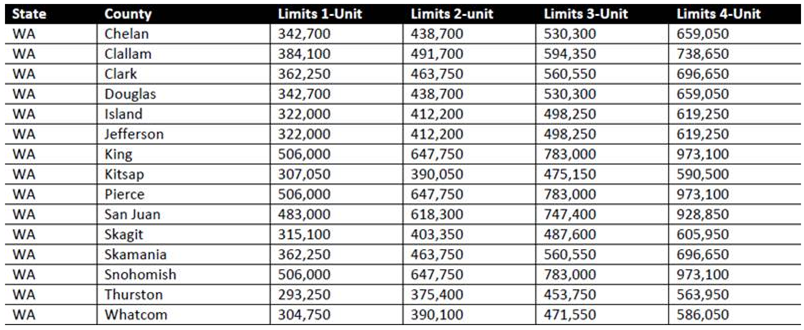

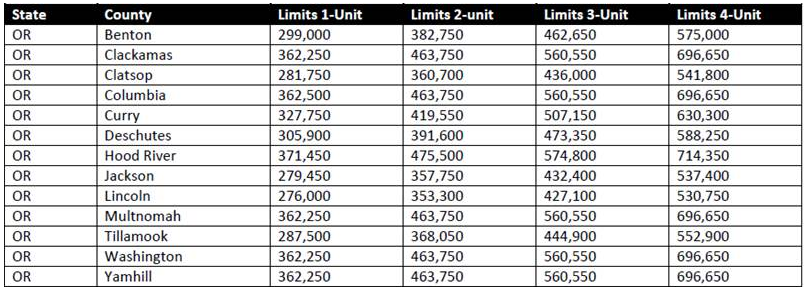

In case you missed it HUD announced the 2014 county-by-county loan limits for 2014. As you will see the maximum loan limits decreased for most all counties across the region. HUD is continuing their efforts to reduce their participation on the “private” mortgage market. Traditionally HUD increases the exposure of the marketplace to FHA loans in a counter-cyclical fashion. When the housing market is having trouble they lower the barriers the entry and when the housing market is strong they make it less attractive. We are currently in the latter phase. Here are the county-by-county loan limits for Oregon & Washington: Oregon: Washington State:

Washington State:

FHA mortgage insurance changes coming

The FHA is extending their efforts yet again to make their loans comparatively more expensive to conventional financing and private mortgage insurance. In their mortgagee letter released on January 31st (see HERE) they announced that for FHA mortgage applications registered after March 31st the monthly mortgage insurance premiums will increase. It’s important to emphasize that these changes only impact new FHA mortgage originations and will not change the mortgage insurance requirements for existing FHA loans. Here the chart featured in the release which shows the changes:

For a $250,000 purchase where a customer is putting the minimum 3.5% down payment this creates an additional monthly expense of about $20 per month.

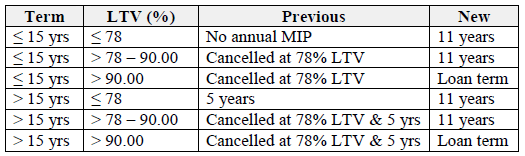

The second change they announced in the letter concerns the duration for which FHA monthly mortgage insurance premiums have to be paid and doesn’t take effect until June 3, 2013. Under the current rules 30-year fixed rate FHA borrowers who put less than 10% down are required to pay their monthly mortgage insurance for at least 5 years. After 5 years they can have the monthly mortgage insurance payments eliminated once their loan balance reaches 78% of the original purchase price (or appraised value if original FHA loan was a refinance). Under the new rules FHA borrowers will be required to pay monthly mortgage insurance for the entire term of the loan.

Collectively these changes will create added incentive for homebuyers to seek non-FHA forms of lending such as conventional financing with lender paid mortgage insurance. However, conventional loans have additional layers of underwriting requirements making them more difficult to obtain. Borrowers who have to rely on FHA financing will likely want to look for ways to fast track their finances so they can replace their FHA loan with a conventional mortgage after a couple years.

What Are FHA Minimum Property Requirements?

Homes that are the subject of a FHA mortgage application must meet minimum property requirements as determined by the Department of Housing and Urban Development (“HUD”: the agency which oversees the FHA mortgage insurance program).

I am often asked if specific repairs will be required by the lender when a FHA loan is in play. The guidelines are actually easily accessible, so I thought I would post them here.

If you are a realtor, I would encourage you to read chapter 3 of HUD handbook 4150.2. This section covers the Valuation Analysis for Single Family One- to Four- Unit Dwellings (4150.2).

You should also familiarize yourself with chapter 2 of HUD handbook 4905.1. This section covers the Requirements for Existing Housing One to Four Family Units (4905.1).

Since underwriters don’t make visible inspections of homes, they rely on the appraiser to inspect the home and highlight any “lender required repairs”.