Last week various mortgage institutions announced a new program designed to help struggling homeowners weather the present economic downturn. It allows homeowners who qualify to suspend mortgage payments for up to 12 months and avoid late fees and late payments reported on their credit record. However, the program has pitfalls that homeowners need to be aware of. Please watch this video to learn what consumers should be asking BEFORE they agree to the forbearance program:

I hope this video is helpful! Please feel free to share with others.

Category: Housing & Real Estate

How home affordability is impacted by higher mortgage rates

As you may be aware mortgage rates are on the rise which is negatively impacting home affordability.

Over the past five weeks average fixed rate home loan rates have increased by ~.50%. Many analysts think that rates will continue to rise for the remainder of the year.

How much does higher interest rates impact home affordability? Take a moment to watch the video below for an explanation.

A .50% increase to mortgage rates effectively translates to a +6.3% increase to home prices.

In other words, a +.50% increase to interest rates for a conventional 30-year fixed rate mortgage has the same impact on monthly payments as if interest rates were unchanged and homes were 6.3% more expensive.

If rates should increase by an additional .50% over the remainder of the year this would make homes ~12% more expensive even homes don’t appreciate as a result of the basic tenets of supply and demand.

Given that many analysts think both mortgage rates and home prices are expected to increase for the remainder of 2018 it may be significantly less affordable to buy a home in the future than it is today.

Are you curious to learn about the options you have to purchase a home today? Contact us for a no obligation review.

Understanding Tax Deductions on a Residence

I am often asked by customers to explain the tax deductions associated with owning a home. Although I am a CERTIFIED FINANCIAL PLANNER™ I always feel hesitant to answer this inquiry because I am not a licensed tax preparer and the tax code is so dynamic I want to be careful not to misjudge a person’s circumstances.

I came across THIS ARTICLE written by two competent tax professionals and thought I would share it. It does a great job of summarizing the tax advantages of owning a primary & second residence as well as the capital gains exclusion.

The article also touches on the possible advantage of unmarried couples co-owning property in high cost housing areas.

Follow Up: Housing Affordability In Portland

Last week I posted an article which highlighted the (welcome) perspective from the state of Oregon’s Office of Economic Analysis that housing affordability will reach an inflection point this year.

It turns out that the chief economist for the aforementioned office delivered a talk to the City Club of Portland a couple weeks ago. His talk can be seen in the you tube video below.

His comments on housing start at the 9:00 mark and last for approximately 10 minutes.

Do you agree with Mark’s comments on the housing market? What is your perspective? Please feel free to add your thoughts in the comment section.

Will Housing Affordability In Portland Continue To Worsen?

There is no question that housing affordability has been one of the most talked about topics in the Portland area since the Great Recession. Rising rents and rising home prices have been a strain on many households across our region.

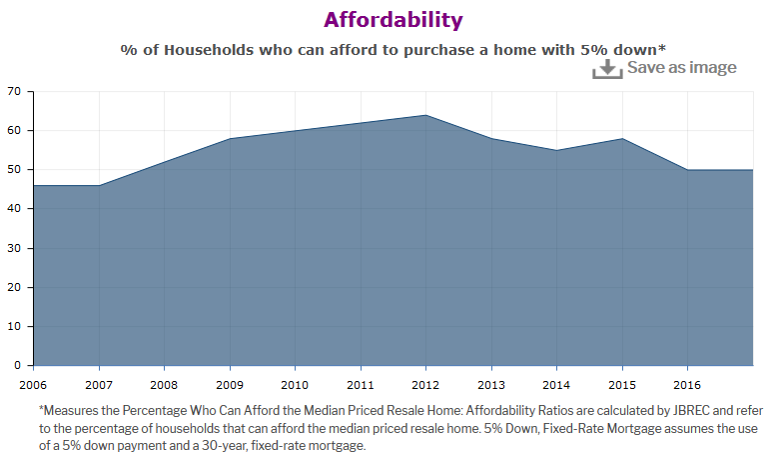

According to John Burns Real Estate Consulting, only 50% of Portlanders can afford a median priced home with a 5% down payment. This is down from ~63% in 2012 and is likely to go lower since the graph below does not take into account mortgage rate increases following the election.

That said, nothing lasts for ever. Josh Lehner of the Oregon Office of Economic Analysis (@OR_EconAnalysis) wrote an article recently entitled The Housing Inflection Point, in which he argues that affordability has reached an “inflection point”.

He is not saying that home prices will decline or that affordability will return to previous levels. He is simply stating that he believes that affordability will not continue to worsen.

“What I really mean is that affordability will stop getting worse. This goes for both ownership and rentals. Now, it may not improve considerably for some or even most households. And I do not expect affordability to suddenly return to previous levels, but it does mark a step in the right direction. A necessary but insufficient condition, if you will.” – Josh Lehner, Oregon Office of Economic Analysis

Lehner presents some very good data points, including the additional supply of apartments either already on or soon to be on the market (which should stabilize rents), additional housing inventory in Cooper Mountain/South Hillsboro/Clark County (which should slow home price appreciation) and rising household incomes. It’s definitely worth a read.

What do you think? Do you believe housing affordability in Portland will continue to worsen at a pace seen over the last five years? Will it improve? Please share your thoughts in the comment section.

The impact of rising mortgage rates on purchasing power

As many prospective homebuyers are painfully aware mortgage rates have taken an acute shift higher since the election back in November. Mortgage rates have increased by .50%-1.00% depending the loan program and down payment. Depending on a prospective homebuyers approach this will impact people in different ways.

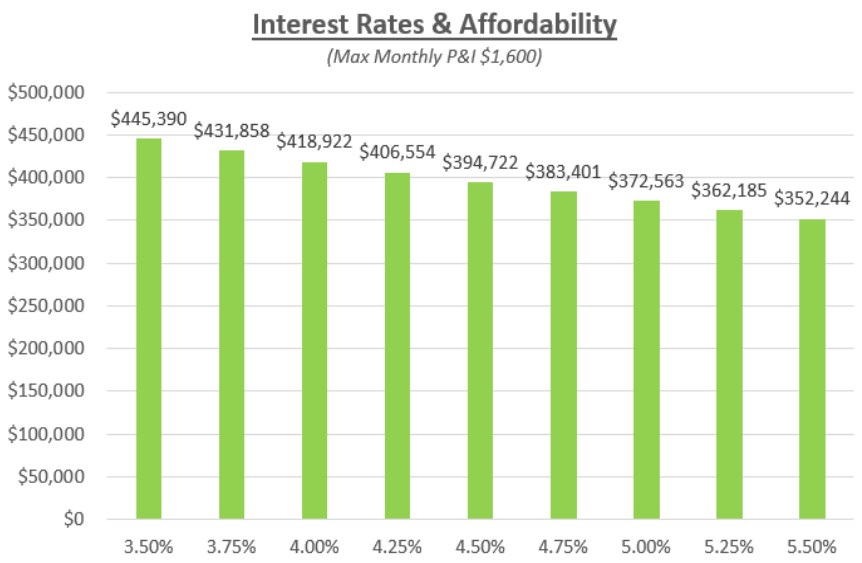

Lets look at an example of a homebuyer who is committed to a specific monthly payment of $1,600 per month for principal & interest or approximately $2,000 including property taxes and homeowner’s insurance (not an uncommon budget for the Portland-metro area).

The chart below shows the maximum purchase price that buyer would need to look within assuming a 20% down payment.

As you can see throughout the summer of 2016, when mortgage rates were in the 3.50% range, a homebuyer with this budget could look for a home in the ~$445,390 price range and maintain payments within their target budget.

However, as mortgage rates have increased closer to 4.50% today their maximum purchase price has declined by ~$50,000 to ~$394,722. Effectively, a 1% increase in interest rates for a 30-year fixed rate mortgage reduces a homebuyers purchasing power by ~11%.

We do not know what the future holds for mortgage rates. As I have written repeatedly as of late in my ‘rate update‘ category I happen to believe interest rates have overreacted to the results of the election. If I am right then rates will reverse modestly lower and purchasing power will increase.

However, if I am wrong rates may continue to trend higher and homebuyers will need to either be willing to spend more per month or settle for less house.

Are you a prospective homebuyer? If so, I would love to be a resource for you. Please contact me for an initial phone conversation.

Is there a bubble forming in Portland?

As those of us in the Portland, OR housing industry know the current imbalance between supply and demand in our local market is a little bit concerning. Stories of multiple offers, waving contingencies, and sales way above asking are everywhere and for some the prospect of buying a home may seem impossible.

Fortunately, I am hearing from Realtor professionals that they are getting more and more inquiries from sellers as we move into spring. This is a welcome sign because greater supply is the only thing that will ease the existing pressures. Portland is a very desirable place to live and we expect demand to remain strong.

That said, I have heard some participants voice concerns about a real estate bubble brewing. I thought I would share an info-graphic that John Burns released last week on his blog:

At this point I do not forecast a bubble popping in Portland. Demand remains very strong and the outlook for jobs in our area looks solid. As long as there is a lack of supply I don’t see how prices can fall. Should those dynamics change in the future, which is entirely possible, then I would have to adjust my forecast.

What are your thoughts? Please feel free to comment.

Interest Rate & Housing Outlook for 2016

It was John Kenneth Galbraith who once said, ‘Economists don’t answer because they know. They answer because they are asked.‘ The reality is that no one has a crystal ball. That said, economists tend to use technical sounding language and accompany their forecasts with plenty of graphs so many of us like to think they may be able to accurately peer into the future.

One of the most esteemed housing economists is Dr. Frank Nothaft who holds the position of Chief Economist for Core Logic. His national housing outlook for 2016 was published in the December 2015 issue of ‘The Market Pulse’ report. His predictions are:

- Mortgage rates up 0.5%

- Household formations exceed 1.25 million

- Rental market remains ‘tight’: vacancy low, rents rise

- Owner market: sales up 5%, home prices up 4-5%

- Originations: less single-family, more multifamily

Looking for a more local outlook? the ‘Portland Business Journal’ released THIS OUTLOOK in their latest issue.

Want to know what I see? I tend to think the Portland housing market will remain strong in 2016. The outlook for the local job market is robust when you take into account the Nike expansion, OHSU Knight Cancer Research Center expansion, Under Armour relocation, and the local tech industry. The question is whether housing inventory will begin to loosen or remain ultra-tight. I believe mortgage rates will increase gradually over the course of the next 12 months (assuming no unforeseen adverse economic or geopolitical event) but remain below 5.00% for a 30-year fixed rate. The reality is inflationary pressure is still meager which will prevent rates from increasing more than that. With rates rising gradually I am hopeful, but not convicted, that would-be sellers will be encouraged to bring their homes to market and relieve some of the imbalance between demand and supply. In another year, I think we’ll look back and see that the median home price will have increased by 5-7% locally with multi-family properties outperforming single family residences.

What do you think? Feel free to leave your view in the comment section below.

Oregon Office of Economic Analysis: Is 2015 Peak Renter?

Josh Lehner, an economist that works for the Oregon Office of Economic Analysis, continues to do excellent work. Earlier this month he released a blog post (SEE HERE) in which he predicts that 2015 could be a peak renter year for Portland. How did he arrive at this conclusion?

Josh looked at demographic data from the census bureau which shows that the bulk of millennials, a large population cohort for Portland, are currently right around 25 years old. They are at the beginning of what he refers to as “root-setting” years (ages 25-45). During these years people tend to get married and have children and as a result create new household formations. For example, presently 80% of 25 year old’s in Portland rent their home (implies 20% own). Comparatively, approximately 30% of 45 year old’s rent (meaning 70% own their homes).

In 10 years 35 year old’s will be the single largest age cohort according to population projections. If we assume that 50% of them will own and 50% will rent (current breakdown for 35 year old’s) then we’d assume demand for home ownership to rise in the next 10 years.

Josh predicts that demand for multi-family housing (think apartments, 2-4 unit plexes, and condo’s) could weaken and demand for detached single family homes in good school districts will grow. A word of caution, he acknowledges that tastes and preferences can change over time and given that rents and home prices continue to rise in Portland it’s difficult to know how the future will play out.

That said, it is a very interesting post and worth a read.

Portland Business Journal: ‘Portland a terrific value’

The Portland Business Journal did an interesting analysis over the past few months. In conjunction with its sister papers across the country it measured the affordability of different metropolitan areas by collecting cost data for a variety of consumption categories (see FULL STORY HERE). Everything from a large bucket of popcorn at the movie theater to housing was analyzed (see the cool info-graphic HERE). So how did Portland fare?

According to the results of the study Portland ranked no. 78 out of 106 markets but that number is misleading because many of the metropolitan areas that were compared are much smaller than Portland. As you might expect Portland was measured to be much more affordable than other west coast cities such as Seattle, San Francisco, San Jose, and Los Angeles.

What might this mean for the housing market? It’s tough to know for certain but theoretically the state should be able to continue to recruit tech companies out of those higher cost areas and bring more jobs to Portland. More jobs is always a good thing for the local housing market.