I hope you took time to celebrate National Roof Over Your Head Day on December 3rd! I showed up to work and helped people get a new roof over their heads so I’m feeling good about my contribution.

Mortgage Rates

Mortgage rates continued to improve last week. They are currently at multi-month lows.

Yield curve

As long-term rates improve the short-end of the yield curve is basically unchanged. The difference in yield between the US 2-year & 10-year treasury notes is only .015%! It appears that the yield curve may invert in the coming months.

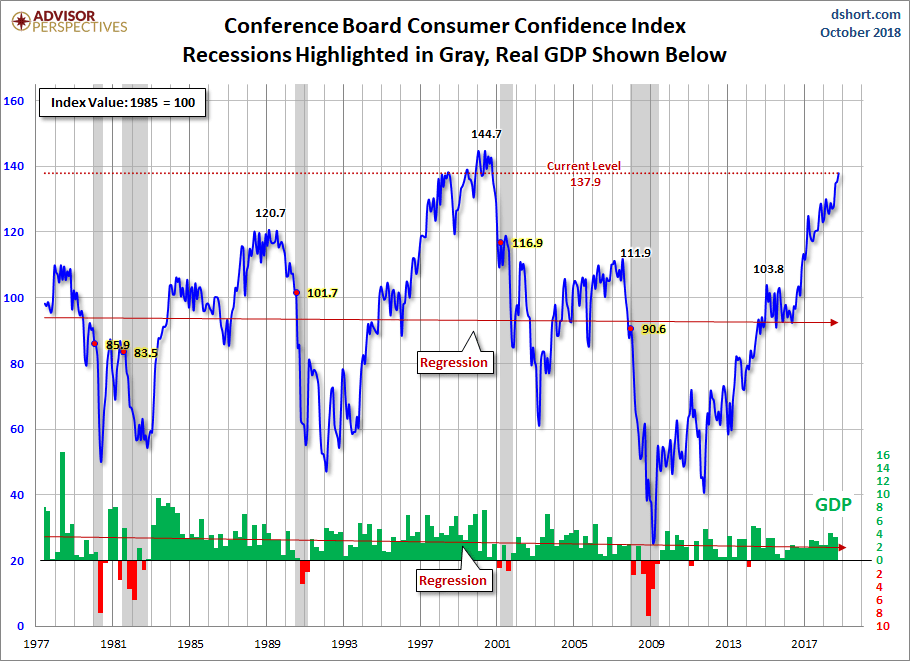

Going back many decades every time the US yield curve has inverted the economy has gone into recession shortly thereafter.

Housing Prices

Corelogic released its monthly Home Price Index today. It showed that homes appreciated by +5.4% nationwide in the past year. Oregon homes appreciated by +6.0% according to the report.

Home prices are still increasing but at a slower pace.

The Week Ahead

The financial markets will be closed on Wednesday this week in honor of President George Bush who passed away over the weekend. On Friday we get the all-important jobs report which can definitely influence the markets.

Current Outlook: floating