Evan Swanson argues that moving out of Portland to save on income taxes might not be financially beneficial, as higher housing costs outside the city could negate the tax savings. He suggests that housing in Multnomah County might be undervalued, making staying in Portland a potentially smarter financial decision.

Tag: portland housing

Mortgage rates improve as builders pick up pace

Home Loan Rates

I recommended “floating” in last week’s ‘rate update’ and that paid off. Mortgage rates are about .125% lower today than they were a week ago.

Trade Talks

Interest rates have improved because optimism surrounding US-China trade talks have subsided. There have not been any new details regarding trade negotiations in the past week and therefore sentiment is turning more pessimistic which is helping US interest rates move modestly lower.

Home Construction

Earlier today the Commerce Department released the latest figures for housing starts and building permits. The figures were stronger than expected and demonstrate that builders are continuing to break ground on new homes.

Ironically, here in the Pacific Northwest the level of residential construction remains historically low relative to in-migration numbers. The result is that home prices and rents continue to rise.

The week ahead

Tomorrow we’ll get minutes from the last Fed meeting. It is expected to show that Fed officials will be on hold from any further short-term interest rate adjustments (CLICK HERE to see why the Fed’s rate cuts don’t matter that much anyways).

On Thursday we’ll get existing home sales from the National Association of Realtors and on Friday we’ll get the latest reading on Consumer Sentiment.

From a technical perspective interest rates appear vulnerable to reverse course and move higher. However, longer-term the stock market also appears over-bought. If we see the US stock market pull back that would be very favorable for mortgage rates.

Current Outlook: locking bias

Existing Home Sales a mixed bag, mortgage rates slightly worse to start the week

Owning your home is still one of the best ways to achieve wealth and as Plato once said “Wealth is known to be a great comforter.” Happy Birthday to Plato who would have turned 1,592 years old today and he lived forever.

Mortgage Rates

We shifted to a locking bias last week and that proved to be the correct call. Although mortgage note rates are mostly unchanged the pricing has worsened meaning the accompanying closing costs are modestly worse.

Home Sales

Earlier today the National Association of Realtors released the monthly existing home sales report. It showed that the number of homes sold during April actually contracted by nationwide. However, on the west coast the number of existing home sales actually accelerated by 1.8% from March.

Coincidentally, the average number of days on market contracted from 36 days down to 24. There is no question that the housing market is less frantic than it was a couple years ago but demand remains strong.

The Week Ahead

This week’s economic calendar is relatively light. On Wednesday we’ll get the minutes from the most recent Federal Reserve monetary policy meeting but no fireworks are expected. On Thursday we’ll see numbers for new home sales.

Stock Market

In the absence of significant economic data I expect mortgage rates to take direction from the stock market. If stocks rally then I expect home loan rates to worsen and vice versa.

Investors remain concerned over US-China trade talks and the ongoing Brexit saga. Any signals that either of these story lines will resolve themselves sooner rather than later would be bad for mortgage rates.

Current Outlook: neutral

Mortgage rates improve on heightened trade tensions

A HUGE THANK YOU to all the teachers and educators who work hard to support our children in their growth and development. Today is National Teacher Appreciation Day.

I’d like to thank Professor Randy Grant of Linfield College who helped me find a passion for economics and finance. Thank you Randy! You are an excellent person and educator.

Mortgage Rates

Mortgage rates have improved modestly in the last couple days thanks to uncertainty around a new trade deal with China.

Over the weekend US trade officials threatened China with additional trade tariffs if an agreement was not reached soon. In reaction to heightened trade tensions US stocks have declined yesterday and today which has helped home loan rates improve.

Home Price Appreciation

Earlier today CoreLogic released its Home Price Index report for March. It showed that national home prices increased by 3.7% from last year. It also forecasted that home price appreciation would accelerate to +4.8% in the next year.

Demand for housing

Zillow released THIS POST yesterday which highlights the demographics of the US and how it is supportive of demand for housing. According to the article an additional 3.11 million people which reach “prime first-time home-buying age” (34 years old) over the next eight years. Portland’s age demographics mirror this forecast.

The Week Ahead

The economic calendar is light this week. There are a handful of Fed officials with scheduled speeches including Chairman Powell who will speak on Thursday. On Friday the Labor Department will release the latest reading of the Consumer Price Index.

Current Outlook: locking bias

US stock market rally pressures mortgage rates higher

Think owning Portland real estate is a great investment? Try purchasing a professional sports franchise.

The late Paul Allen purchased the Portland Trail Blazers in 1988 for $70 million. According to recent reports the Trail Blazers franchise is currently worth $1.6 billion.

Ignoring annual cash-flow the team has appreciated at a 10.6% annualized rate over that time (which outperforms housing).

The Blazers will try and outperform their 1st round opponents tonight at the Moda Center and advance to the 2nd round of the NBA playoffs. Go ‘zers!

Mortgage Rates

Home loan rates have been trending modestly higher since the end of March. They have increased .125%-.25% which is not a surprise given that during that time the yield on the US 10-year treasury note has increased from 2.37% to 2.57% (+.20%). Mortgage rates tend to track changes in the the 10-year treasury note yield.

Technical Signals

The US 10-year treasury note has been trading at its 50-day moving average for the past week. The technical signals suggest that bonds are oversold which means that yields may improve in the coming days.

That said, if yields break above this level then mortgage rates are likely to worsen by another .125%-.25%.

US Stocks

Much of the reason interest rates have suffered during the month of April is because the stock market has been rallying. Strong earnings from various companies have pushed investors into stocks and US indexes are now hovering near all-time highs.

The Week Ahead

The remainder of the week is relatively light on economic news so I expect markets to react to technical signals. Given that momentum is working against us I think the safe play is to lock so will remain with that bias. That said, I am hopeful the aforementioned technical levels can help interest rates improve.

Current Outlook: locking bias

Rates remain low, home prices continue to rise

Happy National Peanut Butter & Jelly Day. I wish I had more time to celebrate but my schedule is JAM packed!

Mortgage Rates

Home loan rates continue to hover at 13 month lows. Although economic data out on Monday was relatively strong there are still concerns over Brexit and future growth which is helping US interest rates remain low.

Home Prices

Earlier today CoreLogic released its monthly Home Price Insights Report. It showed that nationwide home prices increased by 4% from last year. This marks a slowdown from prior years but they also foretasted that for the next 12 months home prices would increase by 4.7%.

Idaho lead all states with +10.2% year-over-year appreciation.

Interest Rate Forecast

Embedded in the aforementioned report CoreLogic Chief Economist Frank Nothaft said, “….the Federal Reserve’s announcement to keep short-term interest rates where they are for the rest for the year, we expect mortgage rates to remain low and be a boost for the spring buying season.”

The Week Ahead

Being that it is the first week of a new month we will get the all-important jobs report this Friday. Analysts are expecting +179,000 new jobs for the month of March and the unemployment rate to remain at 3.8%.

I am a little concerned that interest rates are overdue for a reversal so am going to recommend locking ahead of Friday.

Current Outlook: locking

As job growth slows mortgage rates improve

As you read this take a quick look around. Do you see a few things that were ‘Made in China’? On this day in 2001 China joined the World Trade Organization. Currently President Trump is working to resolve trade tensions which are helping to contribute to lower mortgage rates.

Mortgage Rates

Home loan rates have benefited from recent weakness in the stock market. One of the major factors contributing to stock market weakness has been the lack of progress on trade talks with China.

There are reports that progress is being made but for now key differences remain. If and when the US and China reach a trade deal we may see the stock market rally which presumably would cause mortgage rates to rise.

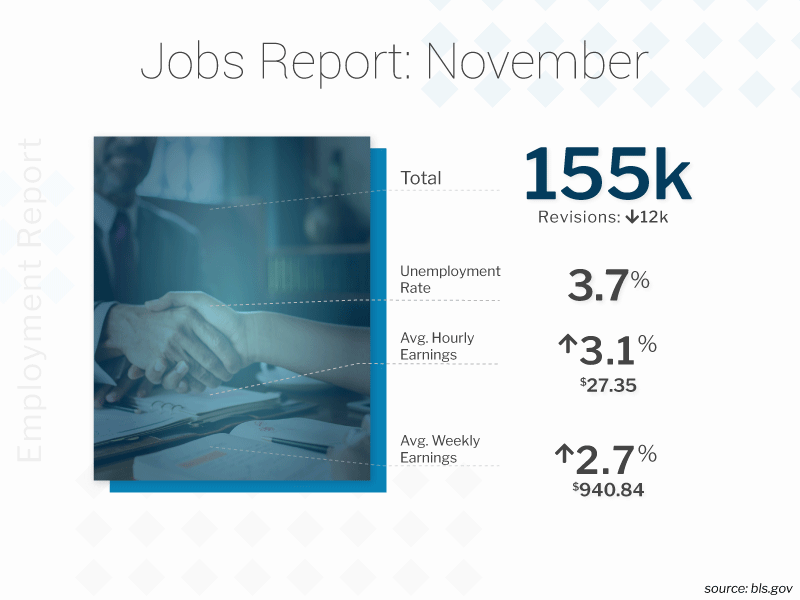

Job growth declining

Last Friday’s all-important jobs report showed that 155,000 new jobs were created in the previous month. This was less than the 190,000 that were expected. The trailing three-month average has decreased to 170,000 which is the lowest of 2018. Some economists are predicting an economic slowdown for 2019-2020.

Inflation Sensation

Ultimately inflation is the key driver of interest rates because if a lender forecasts that the purchasing power of money repaid in the future will be diminished they will charge a higher interest rate.

The Labor Department reported earlier today that prices at the wholesale level of the economy (Producer Price Index) increased by 2.7% last month when you strip away volatile food & energy. This is a modest increase from last month.

Tomorrow the Consumer Price Index will be released.

Technical Signals

Mortgage rates are .375% better than they were a month ago. It appears to me that the rally lower has lost steam. I think the risks of mortgage rates reversing higher outweighs them improving so recommend locking.

Current Outlook: locking

Home loan rates improve modestly along with home values

As a father of two I wish Halloween fell on the weekend. Ever wonder why it is celebrated on October 31st? You can find out HERE.

Interest rates

After hitting recent highs back on October 9th mortgage rates have improved very modestly. Weakness in the stock market is likely the cause for the improvement in interest rates.

US stock markets have declined 10% from recent highs. When stocks weaken it often encourages investors to re-position capital in the bond market which drives yields lower.

Housing

The Case-Shiller home price index was released today. The report showed that Portland home prices increased by 5.4% from last year. However, compared to the month before home prices were off by .1%.

Although home prices here in Portland continue to increase (as measured year-over-year) they are doing so at a slower rate. The +5.4% increase is the slowest rate of appreciation since 2012 and the Portland market now lags the national 20-city composite index which increased by +5.8%.

Seller Buydown strategy

Please take a moment to watch the video below which is a creative strategy to help bridge the gap between sellers’ willingness to make concessions in the current market and buyers who feel pinched by affordability pressures.

The Week Ahead

The Bureau of Labor Statistics will release its all-important monthly jobs report this Friday. The markets are currently expecting +202,000 new jobs. I won’t be surprised if the actual numbers miss expectations given the volatile weather in the southeast.

Current Outlook: floating bias