As stocks slide mortgage rates benefit

The irony of Thanksgiving and Black Friday on back-to-back days has always seemed funny to me. How is it that we spend one day acting grateful for everything we already have then spending the next day trampling over each other to buy new things?

I wish you a warm and blessed Thanksgiving Holiday!

Mortgage Rates

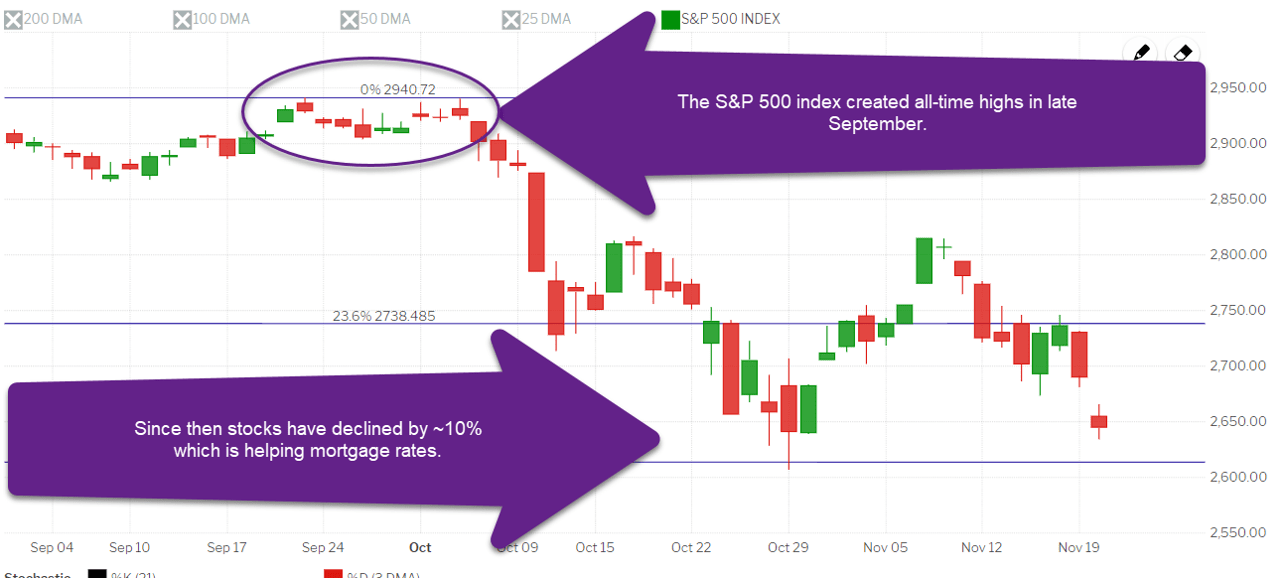

Home loan rates are on a nice run lower thanks to weakness in the stock market. When stocks do poorly investors typically park their money in perceived safe places which includes the US debt markets. The additional demand for these securities drives yields lower.

US Stocks

The US stock market was trading at all-time highs only seven weeks ago. Since then the S&P 500 has fallen approximately 10%. Since July Facebook, Amazon, Netflix, and Google have lost nearly $1 trillion in combined market capitalization.

Is the loss of stock market wealth contributing to the slowdown in demand for home sales? Afterall, in order for a person to make a large financial commitment like purchasing a home they have to feel confident about their future prospects. Lower wealth could cause some people to hold off on buying a home.

Consumer Confidence

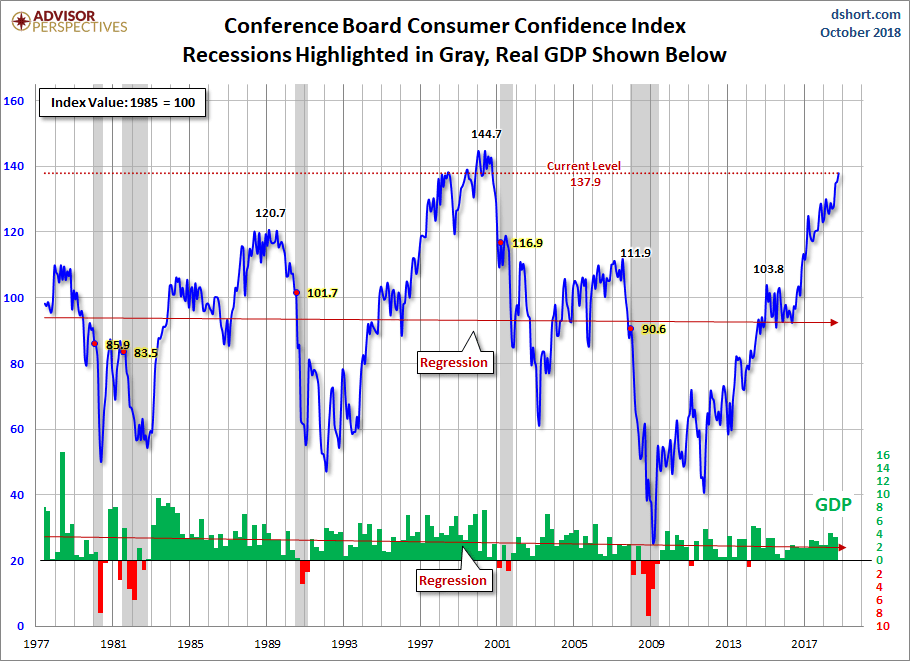

According to the Conference Board the Consumer Confidence Index (CCI) is currently at 137.9. This is the highest level since September of 2000 when it stood at 142.5 so according to this measure households are still feeling pretty good.

However, the CCI has a pretty good track record of being a contrarian indicator as the graph below shows.

The Week Ahead

It is a holiday shortened week and the economic calendar is relatively light. I expect US mortgage rates to react to the stock market. If stocks can rebound and move higher then home loan rates will likely worsen and vice versa.

Current Outlook: floating