Stock market weakness helps mortgage rates

Think Portland has grown? According to Wikipedia there are currently 647,805 residents inside the city limits.

Comparatively, there are 102 cities in China with a population of 1 million or more. Shanghai is the largest with 22 million people. The US currently has 10 cities with a population of 1 million or more.

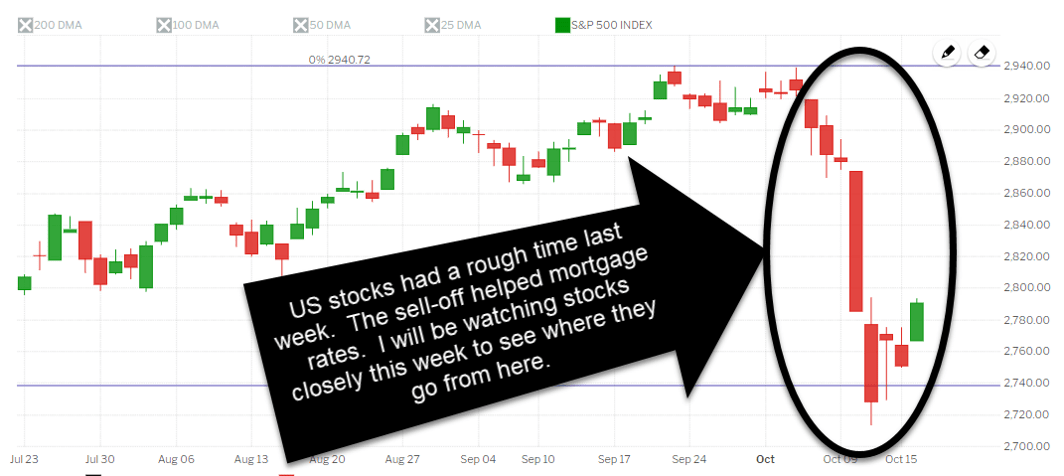

US Stock Market

Concern over the health of the Chinese economy and stalled trade talks contributed to sharp losses in the US stock market last week. In fact, last week’s slump marked the biggest one week decline since February.

Mortgage Rates

When stocks do poorly it encourages investors to sell equity holdings and reinvest the proceeds into the bond market. That additional demand for bonds is what drives yields lower. As a result, home loan rates tend to benefit when stocks sell off.

Although mortgage note rates have not declined they have at least stalled which is a win compared to the sharp increases we saw during the first week of October.

What’s next?

Should stocks continue to sell off I would expect home loan rates to improve modestly. However, if stocks gain footing and recover last week’s losses then it will put further pressure on mortgage rates to move higher.

According to the Case-Shiller price-to-earnings ratio the US stock market us currently trading at 31 times annual earnings.

Dating back over 100 years there have only been two times when this metric has been above 30, 1929 and 1999. In my view US stocks are still expensive which leads me to believe that values will correct at some point in the future which should help US interest rates.

The tricky part is forecasting when.

Current Outlook: floating bias