Home prices increase at a decreasing rate, mortgage rates modestly better

“In the book of life, the answers aren’t in the back.”-Charlie Brown

On this day in 1950 the Peanuts comic-strip made its debut in newspapers.

Italy

Lawmakers in Italy are looking for answers to their financial problems. Earlier today a prominent Italian politician publicly remarked that Italy could solve many of its issues if it abandoned the euro and reverted to its own currency.

His remarks have created some financial uncertainty which is helping US mortgage rates improve modestly.

Home Prices

What’s happening in the housing market?

In the past week we’ve gotten the latest readings on nationwide home prices from the FHFA Home Price Index, Case-Shiller Home Price Index, and (this morning) the Corelogic Home Price Insights report.

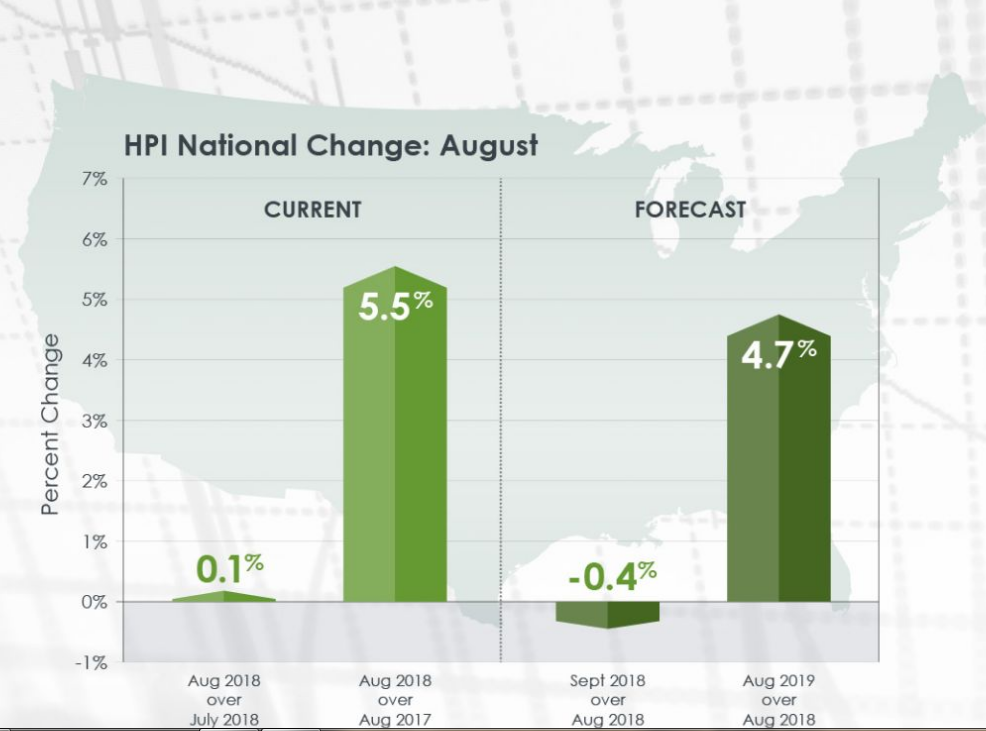

Although each of these reports have different methodologies for calculating changes in home prices they all share similar results. They each showed that home prices increased by 5.5%-6.4% over the past 12 months. Home prices continue to increase but at a decelerating rate (not to be confused with decreasing home prices).

Corelogic projects that home price appreciation will continue to soften. They predict home prices will increase by 4.7% in the next 12 months. By coincidence, 12 months ago they also predicted home prices would increase by 4.7% which turned out to be an underestimation.

Oil Prices

The media loves to focus on the Federal Reserve and the Federal Funds rate when trying to predict the future of home loan rates. However, we know the Fed does not directly control mortgage rates.

I think they should play closer attention to oil prices. Oil prices have increased by ~30% in 2018 and we know home loan rates have increased as well. Energy prices are highly inflationary because they impact virtually every sector of the economy and inflation is the primary driver of mortgage rates.

The Week Ahead

The main economic event on the calendar for this week is the all-important jobs report due out Friday. I will remain in a floating bias but feel less confident than I did last week.

Current Outlook: floating bias