Home Loan Rates modestly worse, Portland home prices entering “Goldilocks” range

A recent survey by the national maritime association revealed that 3.14% of sailors are pi-rates. Why do I share this important statistic with you? Just because yesterday was national Just Because Day.

Mortgage Rates

Although mortgage note rates are unchanged from last week the accompanying closing costs are modestly worse.

US 10-year Treasury

As I highlighted in last week’s ‘rate update’ the US 10-year treasury note had hit a multi-month low at 2.81%. Although we were hopeful the yield may dip below this level and drag home loan rates lower it didn’t happen.

The US 10-year treasury yield responded the same way it has since the beginning of June which is higher. As a result mortgage rates are priced modestly worse than last week.

US Stocks

The equity markets are responding warmly to news that the Trump Administration is close to revised trade agreements with Mexico and Canada. Good news for stocks is often bad news for US interest rates.

Housing

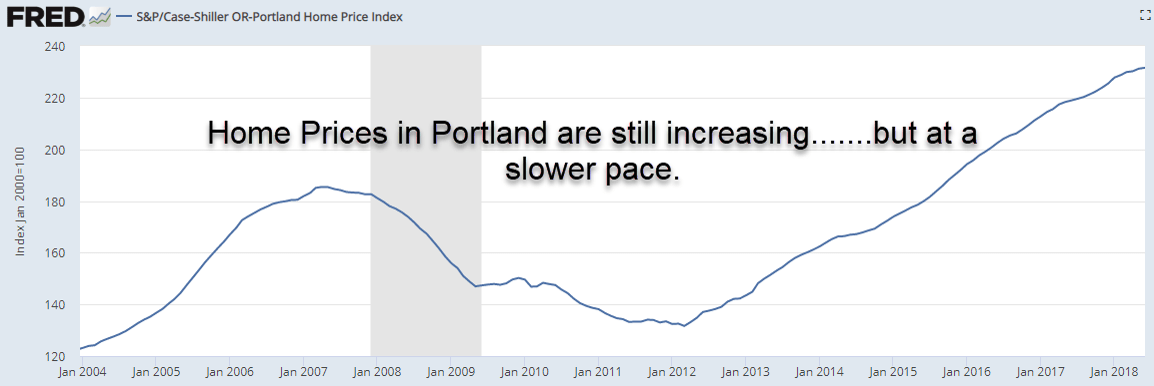

The latest Case-Shiller Home Price Index report was released earlier today. According to the data in the report home prices in Portland increased by 5.8% year-over-year ending in June.

It’s important that consumers understand that the pace of home price gains is declining but home prices are still increasing. I would argue we’re entering “Goldilocks” territory where the market is not too hot or too cold.

Technical Trading Patterns

Given that rates are trending modestly higher I think it makes sense to lock now instead of waiting.

Current Outlook: locking