Happy National Peanut Butter & Jelly Day. I wish I had more time to celebrate but my schedule is JAM packed!

Mortgage Rates

Home loan rates continue to hover at 13 month lows. Although economic data out on Monday was relatively strong there are still concerns over Brexit and future growth which is helping US interest rates remain low.

Home Prices

Earlier today CoreLogic released its monthly Home Price Insights Report. It showed that nationwide home prices increased by 4% from last year. This marks a slowdown from prior years but they also foretasted that for the next 12 months home prices would increase by 4.7%.

Idaho lead all states with +10.2% year-over-year appreciation.

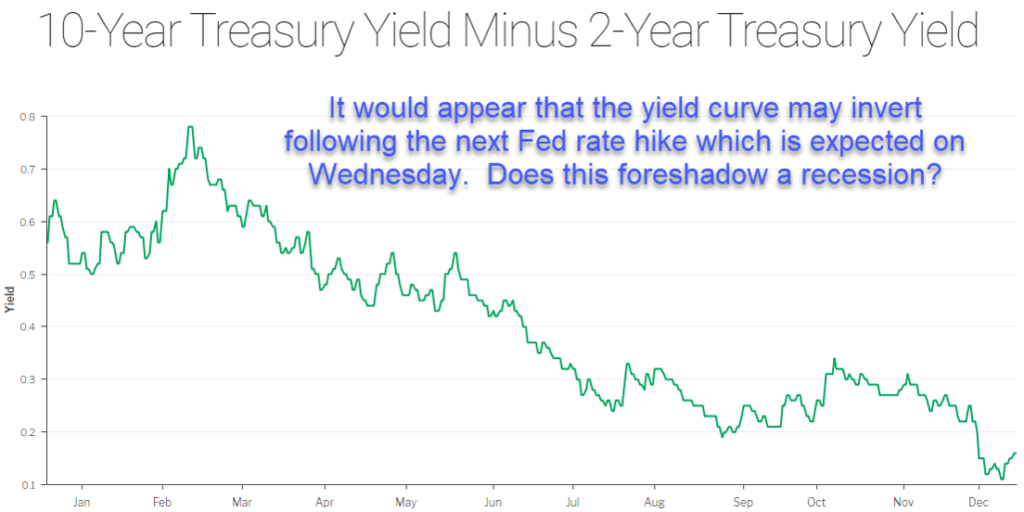

Interest Rate Forecast

Embedded in the aforementioned report CoreLogic Chief Economist Frank Nothaft said, “….the Federal Reserve’s announcement to keep short-term interest rates where they are for the rest for the year, we expect mortgage rates to remain low and be a boost for the spring buying season.”

The Week Ahead

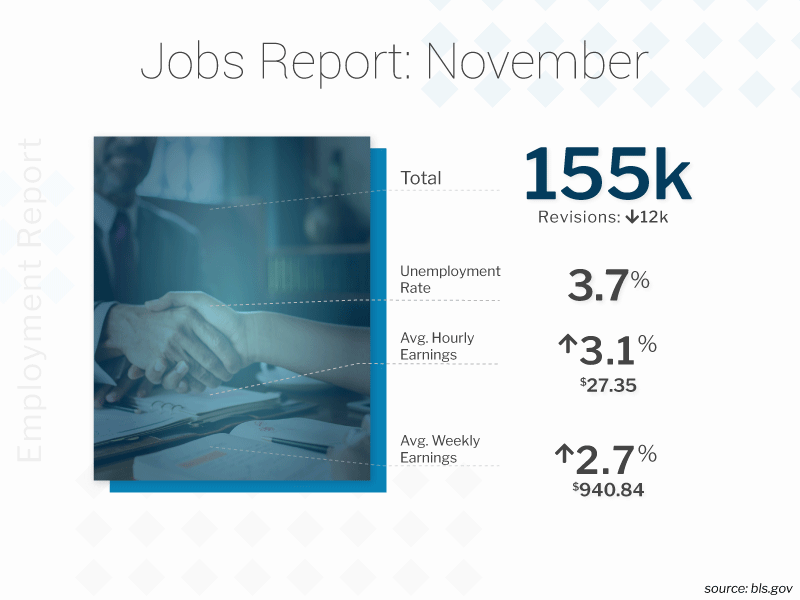

Being that it is the first week of a new month we will get the all-important jobs report this Friday. Analysts are expecting +179,000 new jobs for the month of March and the unemployment rate to remain at 3.8%.

I am a little concerned that interest rates are overdue for a reversal so am going to recommend locking ahead of Friday.

Current Outlook: locking