Are you having withdrawals from the ‘round the clock media coverage of the federal government shutdown? Don’t worry, without a fresh funding bill the government will shut down this Friday at midnight.

Or will it?

Agreement in Principle

According to multiple reports republicans and democrats have reached an agreement to fund the government past this Friday. Assuming the bill is passed and a shutdown is avoided I would expect the stock market to rally (it is up 200 points this morning) and interest rates to increase modestly.

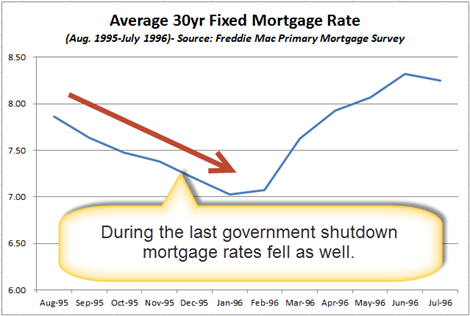

Mortgage Rates

In the meantime, home loan rates remain at 9-month lows and there is plenty of uncertainty to help keep them low. The US and China continue seemingly endless trade talks. If and when there is a trade deal it could spark a stock market rally and hurt mortgage rates.

As I wrote about last week uncertainty about Brexit is also helping US mortgage rates remain low.

On tap this week

Tomorrow the Labor Department will release the latest Consumer Price Index (CPI). Inflation is the primary driver of mortgage rates because it reduces the purchasing power of dollars repaid to a lender in the future. Higher inflation results in higher home loan rates and vice versa.

I’ll also be watching the Producer Price Index which is released on Thursday and Consumer Sentiment on Friday.

Outlook

Mortgage rates remain in a long-term downward trend which I highlighted in last week’s update (see HERE). I will maintain a floating position but am concerned that rates may reverse higher if a government funding deal is reached.

Current Outlook: cautiously floating