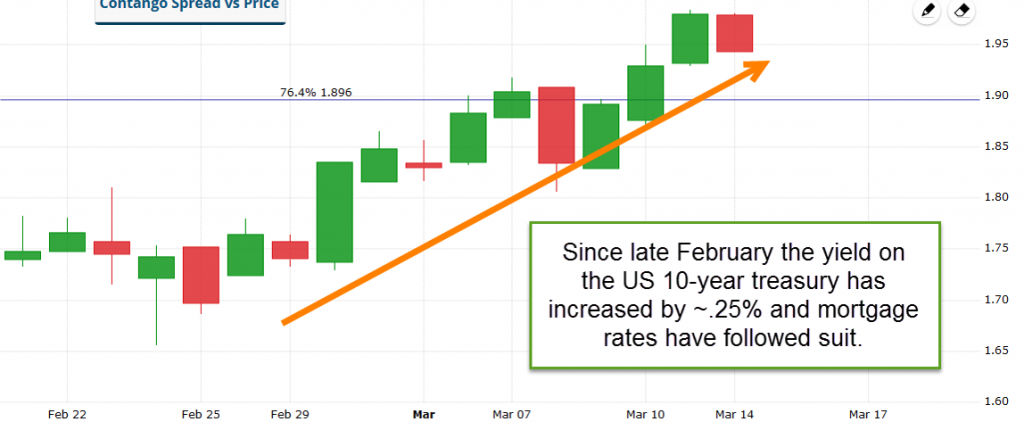

Mortgage rates are priced modestly worse today as compared to the beginning of the week.

Let’s start off with some housing news this morning. Earlier today, the National Association of Realtors released its monthly existing home sales report for June. It showed that the pace of existing home sales increased by 3% nationwide compared to June of 2015. The median home price for homes in the western region increased by 7.2% from June of 2015. Overall, the housing market continues to show strength.

Speaking of strength the US stock market is on a nice run trading at or very near all-time highs. The S&P 500 is up 8.6% since June 27th and the Dow Jones Industrial Average has traded higher for 9 straight sessions. Normally when stocks do well mortgage rates suffer and vice versa.

Nothing lasts forever so should stocks reverse and move lower it could help mortgage rates hit all-time lows again.

From a technical perspective we have to be careful. Mortgage-backed securities are trading below important support and if they fail to recover ground later today it would be a negative sign for mortgage rates headed into the weekend. We can very carefully float to see if stocks reverse course but need to be ready to lock if that doesn’t happen.

Current Outlook: carefully floating