Mortgage Rate Update April 21, 2016

Mortgage rates have worsened slightly from the beginning of the week alongside the yield on the US 10-year treasury note. On Monday the yield on the US 10-year treasury note was 1.77% and currently it is 1.88% (+.11%).

The culprit? Positive signs for the labor are pressuring rates higher.

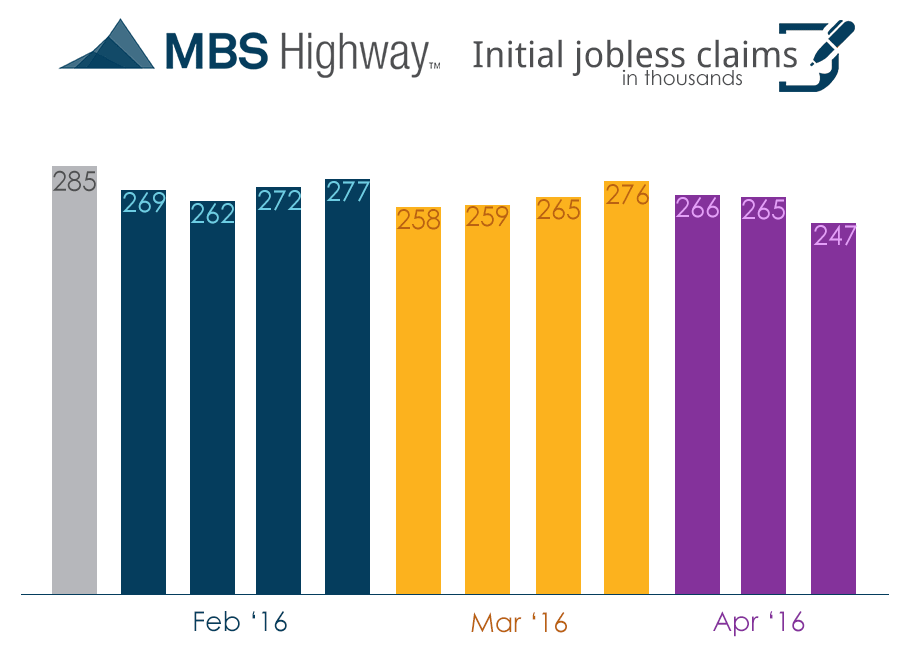

Each Thursday the Labor Department reports on the number of Americans who file for initial jobless claims. The weekly indicator is a barometer for the health of the jobs market. This week’s report showed that the number of Americans filing for jobless claims hit a 42-year low. This week’s results will be factored into the next all-important jobs report scheduled for release on May 6th. Good news for the labor market is often bad news for mortgage rates.

From a technical perspective mortgage backed bonds look vulnerable to further price declines that would pressure rates higher. The US 10-year treasury yield does have resistance that should help cap any additional moves higher.

Given that rates remain very attractive in historical terms I am going to recommend locking.

Current Outlook: locking