Mortgage Rate Update March 14, 2016

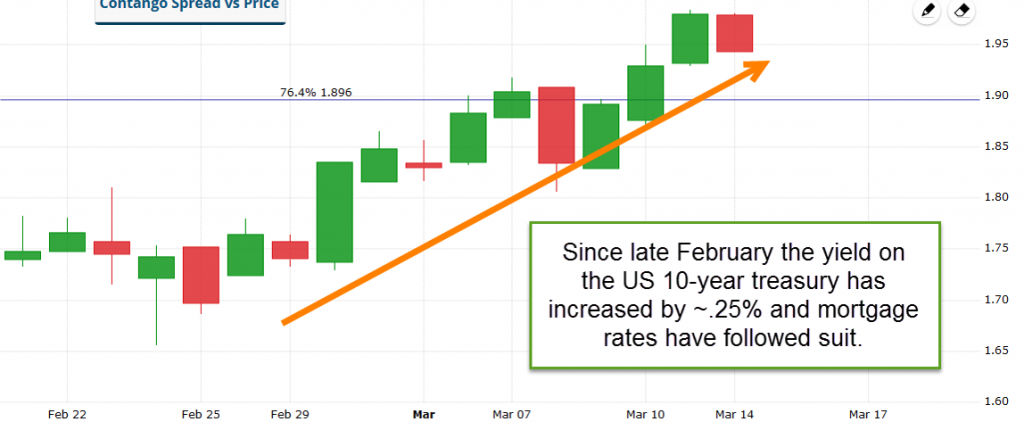

Mortgage rates continued to creep higher last week. Since late February interest rates have been moving higher but still remain below where we started the year.

Although there is no significant economic news out today the remainder of the week features a busy schedule. On Tuesday we’ll receive the monthly report on retail sales and the Producer Price Index. On Wednesday we’ll see the Consumer Price Index, industrial production, and the Fed’s monetary policy statement.

The Fed is not expected to raise short-term interest rates at this meeting (reminder: the Fed does not directly set mortgage rates). However, we won’t be surprised if they sound a little more upbeat regarding the US economy. Furthermore, recent inflationary measures have revealed that price pressure may be building and that could encourage them to lay the groundwork for another rate hike in June. Inflation is the enemy of mortgage rates.

From a technical perspective momentum over the past couple weeks has carried mortgage rates higher. Is this move higher running out of steam? Trading signals suggest this may be the case. I will recommend a floating position for now but we need to be cautious as the Fed’s comments can overshadow technical trading patterns.

Current Outlook: cautiously floating