Mortgage rates are modestly better to start the week.

In case you missed it Friday’s all-important jobs report was a miss. The markets had been expecting 205,000 new jobs for the month of April and instead the report showed only 160,000. This follows last month’s report which showed that only 156,000 new jobs were created during March.

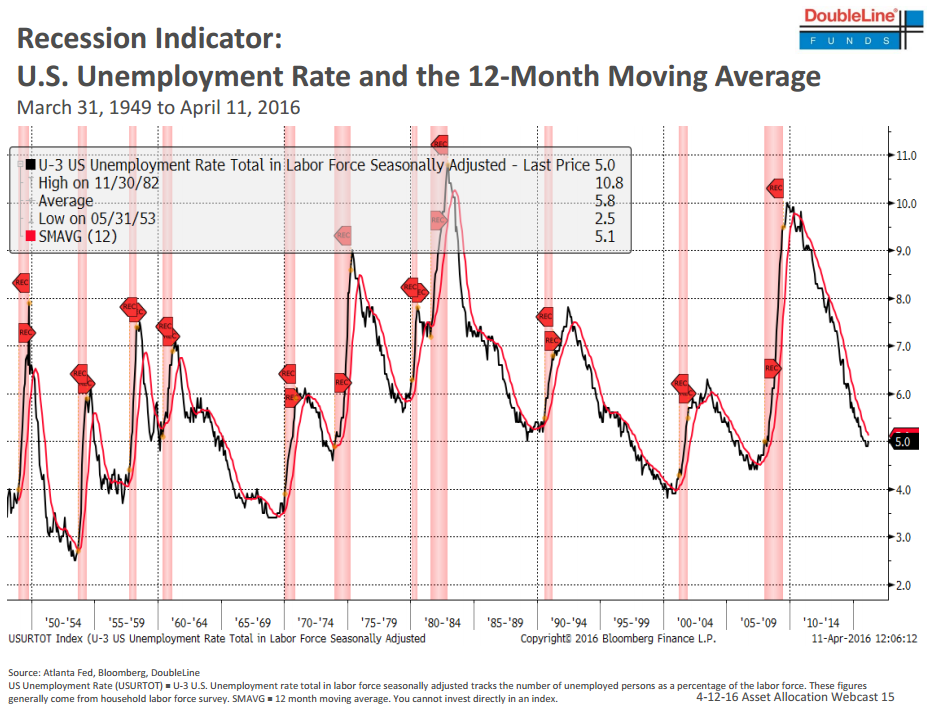

Despite the smaller than expected gains the US unemployment rate remained low at 5.0%. With unemployment at such a low level it’s hard to imagine that an economic slowdown is on the horizon. However, take a peek at the chart below:

This demonstrates that going back to 1950 every recession starts with the unemployment rate reaching a multi-year low just before the economy begins to contract (recessions marked by pink highlights). We don’t know if/ when a recession will come about nor how severe it will be. It is interesting to note that US mortgage rates tend to dip during recessionary periods.

The economic calendar is relatively light this week. I will shift to a floating position.

Current Outlook: floating