Housekeeping: As you may have noticed the past two weeks ‘rate update’ is shifting to once weekly distribution (each Monday). I am working on a new supplemental Thursday format designed to get you ready for the weekend that I will be rolling out after spring break.

HAPPY 1ST DAY OF SPRING! It’s almost time to bust out your shorts from the back of your closet.

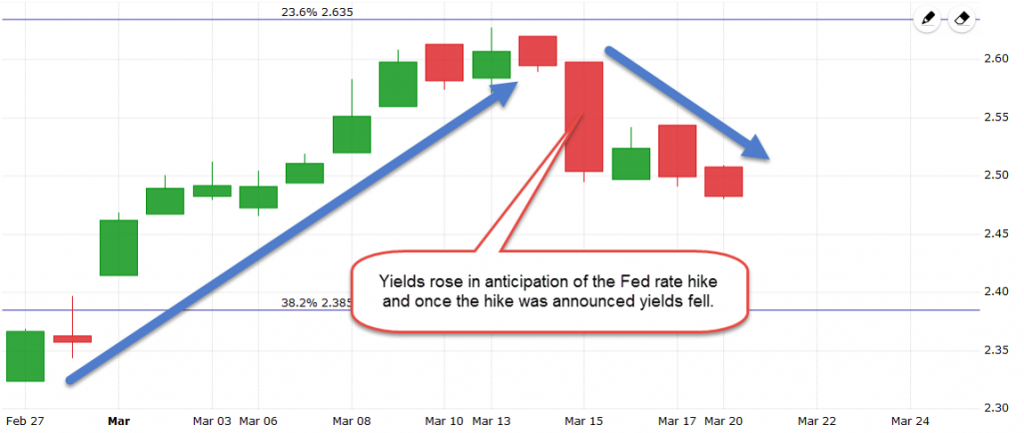

Last week’s advice to “float” proved to be a good decision as mortgage rates did improve following the Fed’s decision to hike rates on Wednesday.

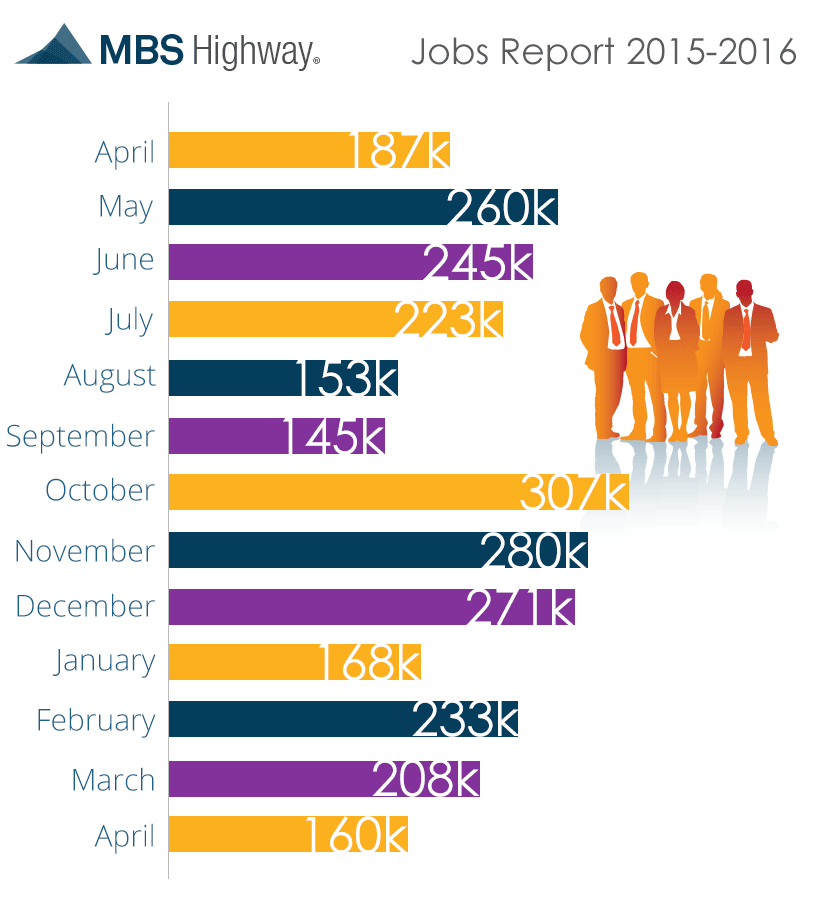

The Fed’s +.25% rate hike announced on Wednesday was not a surprise to the financial markets. Interest rates behaved just like they did the last two times the Fed hiked rates (Dec. 2015 & Dec. 2016). Prior to the announcement yields rose then following the announcement yields fell. The chart below shows the yield on the US 10-year treasury note going from 2.33% up to 2.63% from late February until last Wednesday. Since then yields have retreated back to ~2.49%.

In her post-meeting comments Fed Chairwoman Janet Yellen reiterated the committee’s confidence in the economy and said they would continue to “gradually” hike short-term interest rates (two more hikes expected in 2017). Currently the financial markets are pricing in a ~58% probability that the next Fed rate hike will come in June.

This week’s economic calendar is light. The highlights include the FHFA housing price index (Wed.), existing home sales (Wed.), and new home sales (Thurs.).

I will be keeping a close eye on the stock market and technical trading patterns. After floating last week and seeing some gains I am leaning towards a locking bias this week.

Current Outlook: locking bias