Mortgage rates are unchanged.

Tomorrow the all-important jobs report will be released for the month of May. During normal times this report is the most impactful release and currently it is even more amplified. Why?

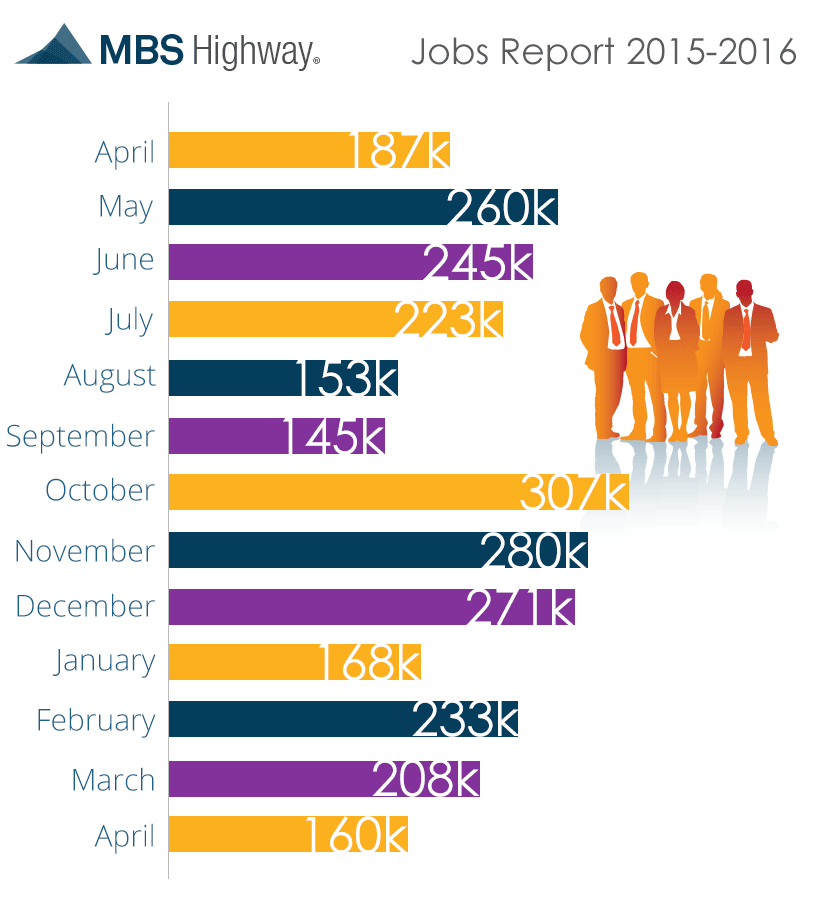

The Fed has been candid in their desire to hike short-term interest rates. However, in order to do so they need reasonably strong employment figures for justification. Inconveniently for them job growth in 2016 has been relatively modest. The US economy has not created more than 250,000 new jobs in a given month since December.

Current expectations for tomorrow’s report is that it will show +155,000 new jobs. As always, if the report shows a figure greater than expectations we’d expect mortgage rates to worsen and vice versa.

All other economic news is overshadowed by the jobs report so we are solely focused on this event. Given that mortgage rates are presently very near 3-year lows I think borrowers have more to lose than to gain so will recommend locking in today.

Current Outlook: locking