With real estate prices and rents booming across the Portland, Oregon metro region over the past few years, it is no wonder that so many people have become interested in purchasing investment property. However, it seems that many would-be investors are not aware of the down payment requirements for buying a home that they intend to rent.

This post was written in November of 2017 and the facts below can change so it’s always best to check in with me to see if these requirements are still accurate.

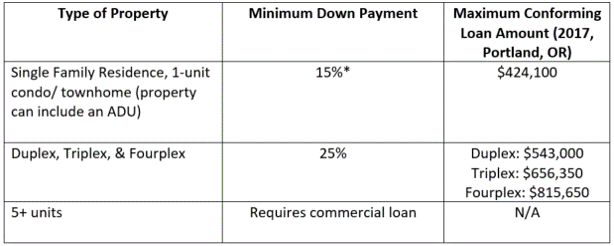

This post is focused on conventional conforming loans for home purchases (excludes refinances) where the buyer intends on renting out the property. The minimum down payment required depends on the type of property an investor is purchasing:

*Although one-unit investment property purchases only require a 15% down payment, a homebuyer will have to obtain private mortgage insurance with less than 20% down which can prove costly and upset the feasibility of the investment.

Also, it’s worth noting that an investment property purchaser who puts 25% down or more will obtain a fixed interest rate that is ~.375% better than if they put less than 25% down. Therefore, stretching to 25% down can greatly improve the financial performance of the investment.

This post is written from the perspective of explaining the minimum down payment required to qualify for a loan. Just because a lender says you qualify doesn’t mean the loan or investment is prudent. Additional analysis should be completed to determine if the investment is suitable given your level of down payment (I can help with that but won’t take up that topic in this post).

Next, let’s outline what sources are acceptable forms of down payment capital. The most common forms of down payment we see are personal checking/savings accounts, investments, mutual funds, inheritances, retirement account loans, and loans against equity in homes already owned. Again, just because a source of capital is acceptable does not mean it is “suitable” and every applicant should consider the trade-offs associated with their transaction. Gift funds are not an acceptable source of down payment when purchasing an investment property.

Underwriting requirements will also require that the applicant have left over capital “in reserve” when purchasing an investment property. Those requirements will change applicant-to-applicant so it’s best to talk to us about the particulars of your situation.

There is no question that owning investment real estate can help families generate wealth in the long-term. I’d love to help you determine if owning a rental property is right for you. Please contact me if you’d like to learn more.