Home Loan Rates

In last week’s update we took a “floating” stance because we thought fear over the coronavirus would continue to grow. That seems like an understatement now.

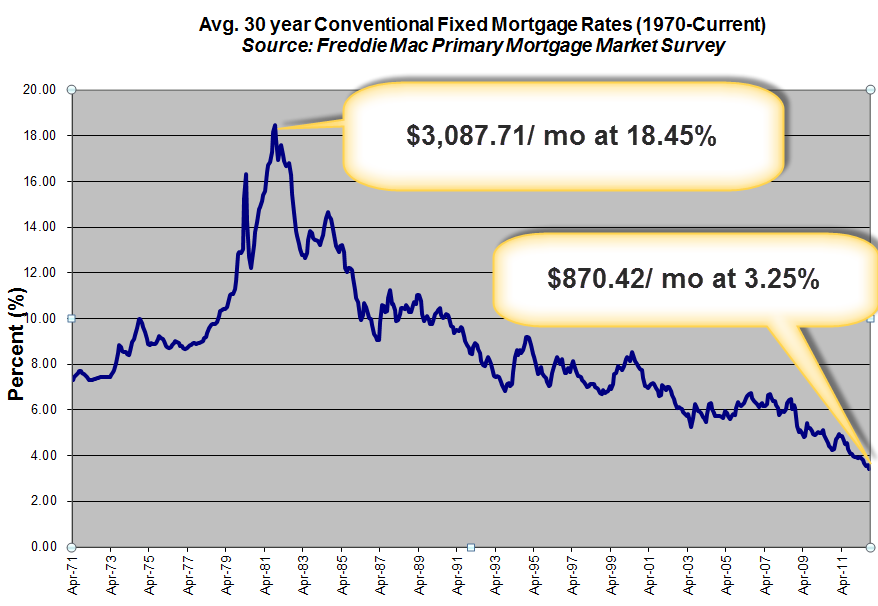

Mortgage rates established new all-time lows on Thursday last week and remain at all-time low levels today.

The Coronavirus

The Coronavirus continues to spread across the US and other countries outside of China.

Experts believe more US citizens currently have the Coronavirus than is being reported.The US is still shipping reliable test kits to medical officials around the country. Once those are deployed I expect the reported numbers of cases to rise significantly.

The spread of the virus will discourage consumers from spending, investing, and generating economic activity. Therefore, many analysts think this could trigger an economic recession. This is the primary reason why stocks are faltering and interest rates are falling.

The Fed

Earlier this morning the Federal Reserve cut short-term interest rates by .50% to try and combat the economic fallout from the Coronavirus.

The Fed controls the Federal Funds Rate which is not directly correlated to mortgage rates. Mortgage rates are the same today as they were yesterday before the Fed cut rates.

The week ahead

It’s the first week of March so we’ll get a fresh jobs report this Friday. However, the financial markets are not focused on the economic calendar given the significance of the coronavirus story line.

I expect volatility to continue over the course of the next few days and weeks. The bottom line is interest rates may very well continue to decrease in the weeks ahead.

Current Outlook: Floating