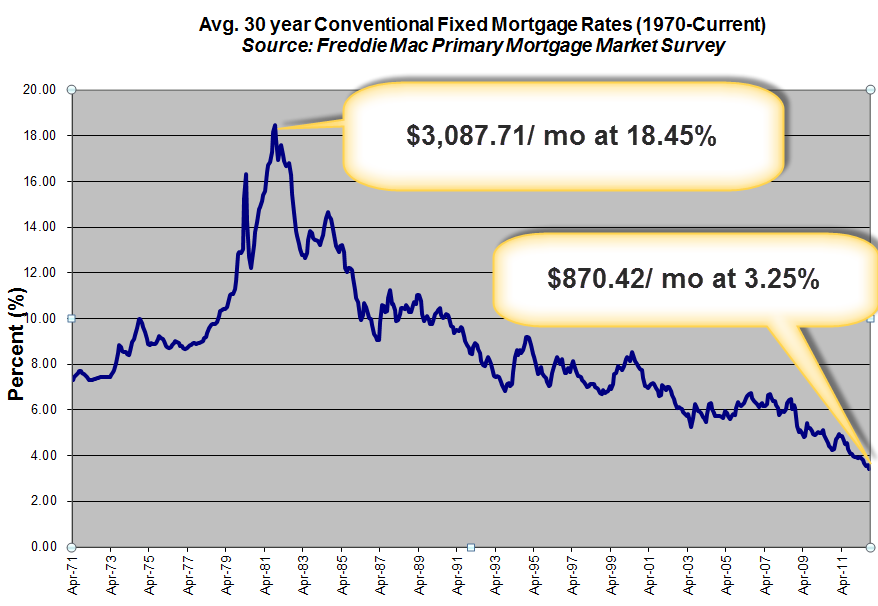

Mortgage rates remain at all-time low levels. The chart below shows just how attractive mortgage rates are relative to the past 40+ years. The monthly payments reflect the monthly principal & interest payment for a $200,000 30-year fixed rate mortgage. The difference between 1981 and today is over $2,200 per month!

The technical outlook for mortgage rates is concerning over the near-term. After an 8-day winning streak mortgage-backed bonds are starting the day lower. I wouldn’t be surprised to see rates worsen over the next week before possibly continuing their march lower.

In domestic economic news the new data out today was mixed. Weekly jobless claims, which tend to be volatile, were reported significantly lower than expected. But orders for durable goods and 2nd quarter gross domestic product were disappointing. Political turmoil in Spain & Greece continue to promote the “flight-to-safety” trade which seemingly have no end in sight.

Current Outlook: near-term locking bias, long-term float