Mortgage rates are unchanged today.

Earlier this morning the Commerce Department released figures for 2nd quarter Gross Domestic Product (GDP). The report showed the US economy grew at a 1.4% annual clip which was higher than the .8% growth during the first quarter but slower than the ~2% average we’ve experienced during this economic expansion.

The Wall Street Journal reported yesterday that members of OPEC have agreed in principle to a future cut in oil production. If a significant agreement is reached and oil prices rise that would promote inflationary pressure which would not be good for mortgage rates. That said, OPEC’s record on reaching agreement amongst all its members is questionable.

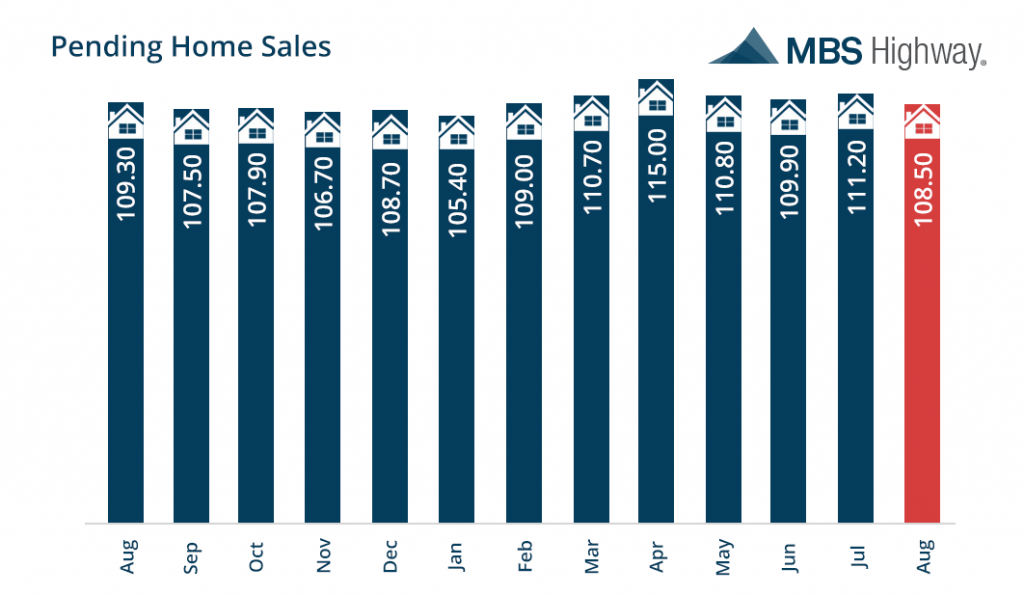

The National Association of Realtors reported that pending home sales declined by 2.4% in August. Low inventory continues to impact the housing market.

The technical outlook for interest rates is neutral. I am going to recommend a locking bias as it feels like momentum may be shifting.

Current Outlook: locking bias