Mortgage Rate Update February 11, 2016

Mortgage rates continue to improve. 30-year fixed rates are now only .125% above the all-time low levels created in the fall of 2012. It is a great time to review your loan and evaluate your options for refinancing. There is a good chance that if you or someone you know has a fixed rate at 4.25% or higher, good credit, and at least 10% equity then we can refinance your note with little or no cost and reduce your payments or loan term.

Why are rates improving so dramatically? First off, stock markets around the globe are down sharply today. As I type the US Dow Jones Industrial Average is down 2.06%, the Japanese Nikkei 225 is off 2.31%, and in London the FTSE is down 2.39%. Investors are shedding “riskier” assets and seeking safety which is driving yields lower.

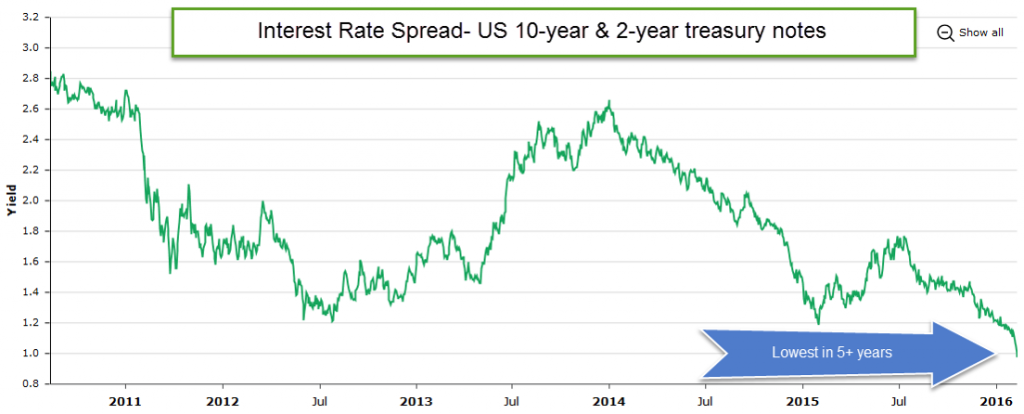

The yield on the US 10-year treasury note is down to ~1.60%. The spread between the US 10-year & 2-year treasury note is at its lowest level in 5 years which is a negative sign for the economic outlook.

Another reason for the convergence in yields is that inflationary pressure remains weak in our economy. In testimony yesterday Fed Chairwoman Janet Yellen highlighted the financial turbulence and acknowledged that it could prevent inflation from increasing this year. In other words, additional Fed rate hikes are likely on hold until things settle down.

Current Outlook: floating