In order to do a FHA loan on a condo the condo devlopment must be approved by HUD. In order to search if a specific condo is HUD approved (so that a buyer can obtain a FHA loan) visit this link.

Category: Low Down-Payment

ACCESS loan for 0% down financing.

0% down financing is getting harder and harder to find these days. The most common approach of creating 0% down financing is through the FHA loophole which allows for a seller to contribute the 3% required down payment via a down payment assistance program such as Nehemiah and Ameridream. However, the Federal Government will eliminate this flexibility with the passage of the latest housing bill. As of October 1, 2008 these loans will no longer be available.

Once that is gone what will be next? I may have found the answer with the ACCESS program we offer in conjunction with National Homebuyer Fund. This program will provide a 2nd mortgage for a homebuyer who meets the qualifications up to 100% of the purchase price (the website states 105% but we can’t get mortgage insurance beyond 100%). Here are a few key points of the program:

*The ACCESS 2nd mortgage cannot exceed 8% of the purchase price & cannot exceed 100% combined loan to value. The structure which creates the lowest monthly payment is a 95% primary mortgage and 5% combination mortgage.

*The ACCESS 2nd mortgage is a 20 yr. mortgage with a fixed interest rate which will be 2.00% higher than the rate on the primary mortgage. It has principal and interest payments.

*The ACCESS 2nd mortgage can be used in combination with a variety of 1st mortgage products including 30 year fixed rates with interest-only payments.

*The ACCESS 2nd mortgage carries no prepayment penalty.

*In order to qualify for this program the applicant cannot have income which exceeds 140% of the median household income (In the Portland area the limit would be $86,800).

Give me a call today if you’d like to see is this program will work for you!

Your Guide to Understanding Mortgage Insurance

When a home buyer takes out a new mortgage and has less than 20% down often times they will be required to provide mortgage insurance to the lender (exceptions exist when we’re able to provide “combination loans” which are fairly uncommon these days).

Mortgage Insurance (also known as “mi” or “pmi‘) is insurance which covers the lender against a portion of their losses should the loan they make result in payment delinquency or foreclosure.

There are various forms of mortgage insurance which home buyers should be aware of. Here is a brief explanation of each:

Borrower-paid mortgage insurance (BPMI)– This is the most common form of mortgage insurance. The insurance premiums for this form are paid for by the borrower on a monthly basis and varies depending on the loan amount, loan-to-value, and credit score of the borrower. With this form of mortgage insurance the borrower can often request that the mortgage insurance payment be removed from their monthly payment once they have established a 24-month clean payment record and can demonstrate that they have 20% equity in the property. However, it’s important to note that the only legal requirement the lender has to eliminate the mortgage insurance is under the Homebuyers Protection Act which states that the lender is not required to eliminate the mortgage insurance until the loan balance is scheduled to reach 80% of the original purchase price based on the original amortization schedule.

Lender-paid mortgage insurance (LPMI or “No mi”)– With this form of mortgage insurance the borrower accepts a modestly higher interest rate in exchange for not having to make a monthly mortgage insurance payment. Often times these plans create the lowest possible monthly payment and can be most tax efficient. The drawback of LPMI is that the increase a borrower accepts to their interest rate is permanent so even when they have achieved 20% equity in their home their rate will remained at the higher level.

One-time or “upfront” mortgage insurance– With this form of mortgage insurance the borrower makes a one-time mortgage insurance payment at the outset of taking the loan and then does not have to make any additional mortgage insurance payments for the duration of the loan. This option works best for a home buyer who is seeking to create the lowest possible monthly payment and has enough money to cover the additional settlement charges (but not enough to put 20% down).

Split mortgage insurance– Split mortgage insurance combines aspects of the BPMI & the one-time mortgage insurance forms. With a split mortgage insurance structure the borrower pays an upfront or “one-time” mortgage insurance payment at closing & accepts a monthly BPMI payment as well. The most common form of this is with the FHA program. With a FHA loan the buyer finances an upfront mortgage insurance premium into the loan amount and makes a monthly mortgage insurance payment. These two amounts are less than if the borrower did the BPMI or one-time mortgage insurance exclusively.

Pros & Cons of the Oregon Bond Program

As mortgage lenders continue to restrict their lending guidelines in response to the “subprime fallout”, it is no wonder that mortgage originators are increasing their reliance on FHA and state-sponsored first time home buyer programs to fill the void.

In Oregon we have the Oregon Bond Program. This particular program is offered through the Oregon Housing and Community Department and is funded through tax-exempt mortgage revenue bonds.

On the surface, the Oregon Bond Program appears to be the “end all, be all” program for ANY first time home buyer. However, it is my goal with this blog post to inform you of the positive and negative aspects of this loan option.

Positive Aspects of the Oregon Bond Program:

- Low/No down payment requirement. The Oregon Bond program has two down payment options for first-time home buyers. The first option called the “Rate Advantage” has a lower interest rate and carries a minimum down payment requirement of 3%. The second option called the “Cash Advantage” requires 0% down on the part of the home buyer. However, at the time of this posting the Cash Advantage program was temporarily suspended.

- Interest Rate. The Oregon Bond Program has a very attractive interest rate. At the time of this blog posting a borrower could lock in a 30-year fixed rate @ 5.75% for the Rate Advantage option. This is about .375% less than a comparable FHA option.

- Flexible credit approval. Like the FHA loan program the Oregon Bond loan can be fairly flexible in terms of an applicant’s credit score. Unlike conventional loans, there are not adverse rate adjustments for applicants with lower credit scores.

Negative Aspects of the Oregon Bond Program:

- Mortgage Insurance. The Oregon Bond loan program carries fairly expensive mortgage insurance requirements. Just like the FHA loan the mortgage insurance is structured with a 1.50% upfront mortgage insurance premium that gets financed into the loan plus a .50% monthly premium that is built into the monthly payment. For example, a $200,000 loan would get financed @ $203,000 to fund a $3,000 mortgage insurance policy at closing plus $83.33 per month.

- Recapture Provision. This provision is often overlooked by borrowers and loan originators, but it can be a costly oversight. With an Oregon bond loan the home buyer may be subject to a recapture tax when the home is sold in the future. For a detailed explanation of this provision I would encourage you to research it at the Oregon Bond website. I will do my best to explain it here. The recapture tax is collected at a rate as high as 6.25% of the original loan amount if the home is sold within the first 9 years of the loan at a higher price than it was initially purchased for if the loan holder’s income exceeds a certain threshold (currently about $70,000) at the time of sale. For example, a home buyer takes a loan out for $200,000 today to buy a home for $225,000. In 5 years, they decide to sell their home. At that time they sell their home for $275,000. If their household income at that time exceeds the threshold (determined at that time) then they would owe $12,500 (6.25% of $200,000) in recapture tax, even if they had refinanced during the course of owning the home.

- Inflexible guidelines. Although the Oregon Bond program is flexible in some degree (mostly credit and down payment), it is considered to be inflexible in other areas. For example, the program requires a 2-year work history in the same industry and school does not count. For many home buyers they have only been out of school for less than 2 years. These borrowers would not qualify for an Oregon Bond program but may qualify for FHA loans. Furthermore, there is a very limited set of Oregon Bond lenders to choose from. Therefore, an Oregon Bond application is subject to the underwriting tendencies of a few different lenders. This differs greatly from FHA where we can originate almost anywhere.

- Income limits. Unlike the FHA loan program, the Oregon Bond loan program REQUIRES that an applicant be a first time home buyer (defined as not having owned in the previous 3 years) and may not have a household income that exceeds a certain level (depending on the county that the property is in). For the Portland-Metro area the income threshold is about $70,000 at the time of this post.

- Processing. Oregon Bond programs have to be reviewed by the lender and the state of Oregon. Typically speaking the process for getting an Oregon Bond loan is much more cumbersome and time consuming than a traditional FHA loan. We like to ask for 45-60 days to get an Oregon bond loan done, whereas we can do FHA loans in a much shorter time frame.

FHA increases loan limits to help housing market

Last week the Federal Housing Administration (FHA) increased the loan limits for FHA loan products. It’s important to understand that this only applies to FHA loans and does not apply to conforming loan limits although the methodology for increasing FHA loan limits is the same. In either case the maximum loan limit is 125% of the area’s median home price.

To find out what the new FHA loan limits are in your area FHA has provided the following website:

http://www.fhaoutreach.com/

For the Portland-Metro area the new maximum FHA loan for a single family residence is now $418,750 which is up about $100,000 from the previous limits.

Here is a link to the announcement on HUD’s website:

http://portal.hud.gov/portal/page?_pageid=33,717234&_dad=portal&_schema=PORTAL

Rate Update Feb 27, 2008

You Tube link to see rate update video: http://www.youtube.com/watch?v=uhh_BCCeazg

After moving higher yesterday morning mortgage rates appear to have reversed course on technical trading patterns and testimony from Ben Bernanke.

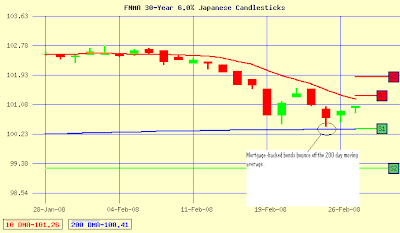

Mortgage-backed bond prices touched the 200-day moving average yesterday morning and despite worse than expected inflation data that would ordinarily weigh on bond prices were able to reverse higher (see chart above).

Today, Fed Chairman Ben Bernanke is testifying in front of Congress on the outlook of the economy. Watch today’s you tube video to hear which comment is helping mortgage rates move lower.

Current Outlook: floating