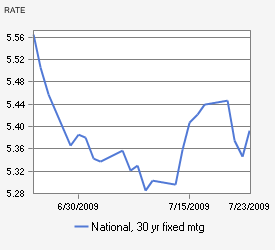

Mortgage rates are unchanged from yesterday.

As I explained in yesterday’s ‘rate update’ we are closely watching the level of foreign participation in this week’s US Treasury auctions. Today there will be $42 billion in US T-bills sold to the market. We wouldn’t surprised to see mortgage rates increase due to the additional supply of bonds on the market.

S & P released their monthly Case-Shiller real estate report. Many experts consider this report to be the most accurate measure of home prices (click here to understand why). The report showed that home prices declined on a year-over-year basis at the slowest pace in 12 months. Many analysts are interrupting this as more evidence that the housing market is at or near bottom.

S & P released their monthly Case-Shiller real estate report. Many experts consider this report to be the most accurate measure of home prices (click here to understand why). The report showed that home prices declined on a year-over-year basis at the slowest pace in 12 months. Many analysts are interrupting this as more evidence that the housing market is at or near bottom.

If you haven’t yet read about the new federal mortgage rules which take effect July 30 and could delay real estate closings you can do so by clicking this link.

Current Outlook: bias towards locking on short-term transactions with additional supply of treasury bills.