Mortgage rates float higher despite Fed cut

Despite last week’s Fed rate cut mortgage rates have actually increased modestly this week. Remember, the Fed does not directly control long-term interest rates (including for home loans).

Stocks/ US-China Trade Talks

Optimism surrounding US-China trade relations is fueling the stock market and hurting mortgage rates. It was reported late yesterday that US & Chinese officials are close to an agreement which will roll back tariffs on $111 billion in Chinese goods.

Analysts are viewing this development as a positive sign that the two sides may be able to create a mutually agreeable trade package. This is good news for the economy and the stock market but bad news for mortgage rates.

Jobs Report

Last week’s all-important jobs report showed that only 128,000 new jobs were created during the month of October. Normally, such a soft number would help mortgage rates improve. However, digging deeper into the report the BLS also revised previously released figures by +95,000 jobs.

Good news for the labor market also equates to bad news for home loan rates.

Housing Prices/ Millennials

CoreLogic released its monthly Home Price Index report earlier today. The release showed that nationwide homes increased by 3.5% over the past 12 months. They also forecasted that home price appreciation would pick up steam over the next 12 months and increase by +5.6%.

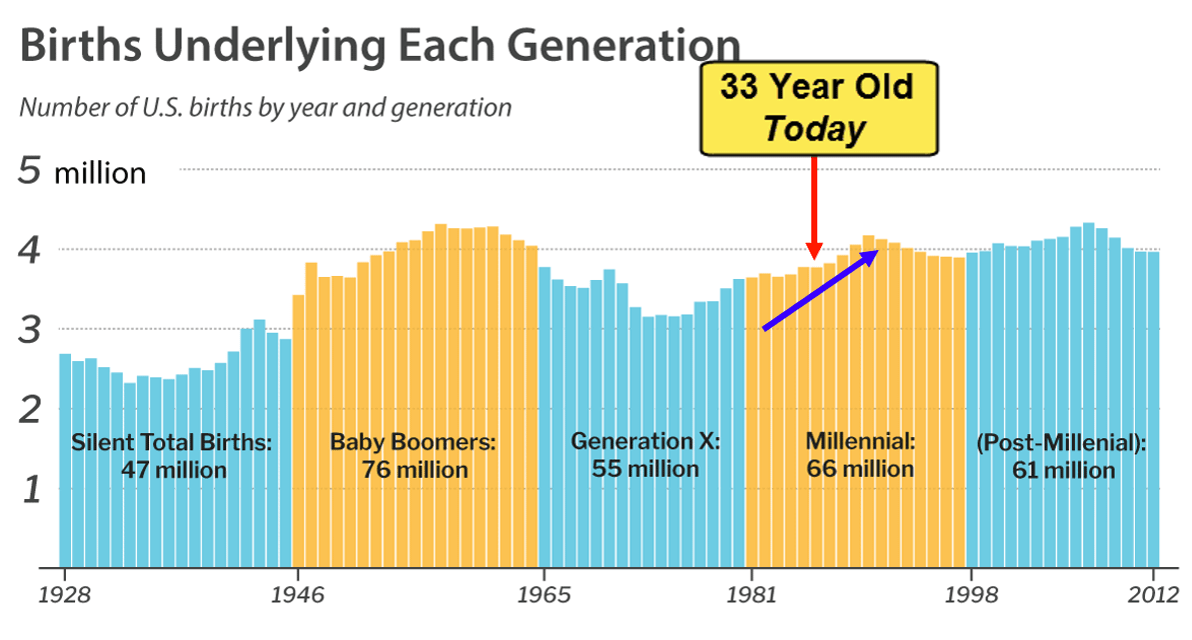

One reason why home prices are expected to accelerate is the demographics of our population. Over the next five years over 30 million people will reach the age of 33 which happens to be the median age of a first time homebuyer in the United States. Even if the economy slows down the trend in population should lend support for home demand.

The week ahead

The remainder of this week’s economic calendar is relatively light. I expect mortgage rates to continue to react to the stock market and sentiment surrounding US-China trade talks. Unfortunately momentum is working against us so I recommend locking.

Current Outlook: locking.