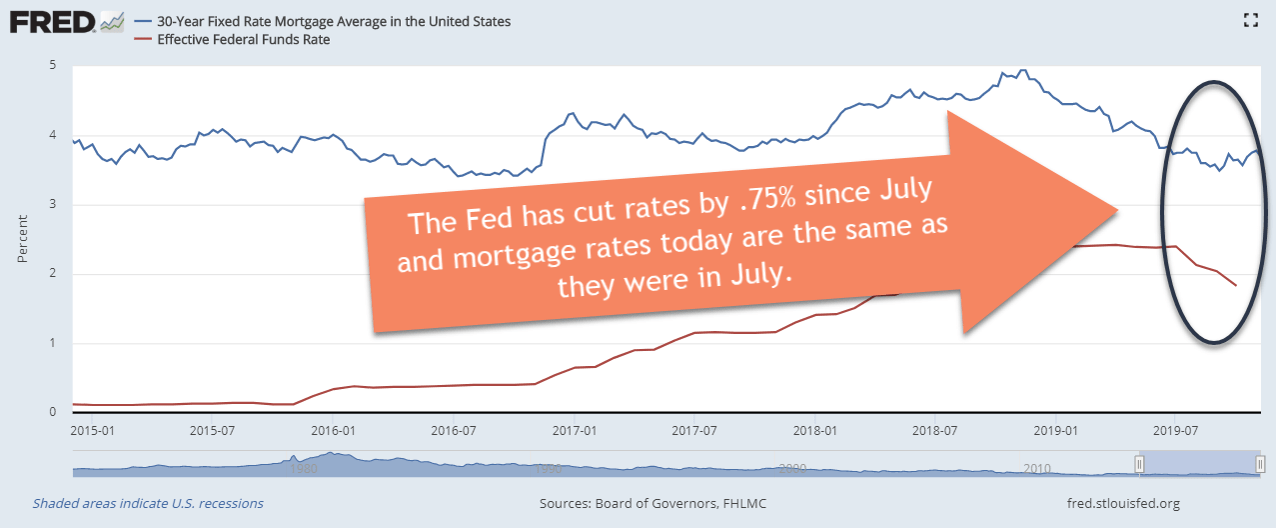

The Fed cuts and mortgage rates don’t budge. Explain that one….

It’s counter-intuitive that when a person blushes, presumably because they are embarrassed, we tend to like them more.

Do you know what else is counter-intuitive?

Home Loan Rates & The Fed

It can be confusing for consumers when the Fed cuts interest rates and mortgage rates go up.

Since July the Fed has made three rate cuts totaling -.75%. However, consumers should know that the Federal Funds Rate, which is what the Fed controls, has a very obscure purpose (see HERE).

Mortgage rates today are effectively the same as they were when the Fed started this campaign.

Mortgage rate forecast

Nobody has a crystal ball but it’s worth noting that Fannie Mae released its latest forecast for housing and interest rates. They are predicting that mortgage rates will average 3.5%-3.6% in 2020. Their forecast includes interest rates with discount points but nevertheless they believe rates will be the same and moderately lower next year.

Trade Talks

Sentiment over US-China trade talks have played a significant role in the direction of the stock market and interest rates recently. Over the past two weeks the financial markets have been optimistic that the US and China will iron out a new trade deal which has hurt mortgage rates and pushed stocks to all-time highs.

However, last week President Trump disputed progress so it’s tough to know what is going on behind the scenes. The President is scheduled to speak in New York City today to a group of economists so any news could drive sentiment and influence the direction of mortgage rates.

The week ahead

This week’s economic calendar features the Consumer Price Index on Wednesday, the Producer Price Index on Thursday, and Retail Sales on Friday. In addition there are Fed officials scheduled to speak through the week.

I recommended locking last week but am going to switch to floating.

Current Outlook: floating