US-China trade talks continue to influence mortgage rates

Happy Birthday to Ken Galbraith who would have turned 111 today. The Canadian economist famously predicted in his 1958 book The Affluent Society that as society becomes more affluent private business would create additional consumer demand through marketing and consequently public goods (i.e. schools & parks) would be neglected.

Seems to me like he was on to something.

US-China Trade Talks

Trade negotiators from China and the US may be onto something too.

There are literally thousands of factors which can influence the direction of mortgage rates. However, over the past few weeks one story line in particular has dominated.

Trade tensions between the US and China began flaring up in March of 2018. Since then both sides have taken a tit for tat approach to trade policy.

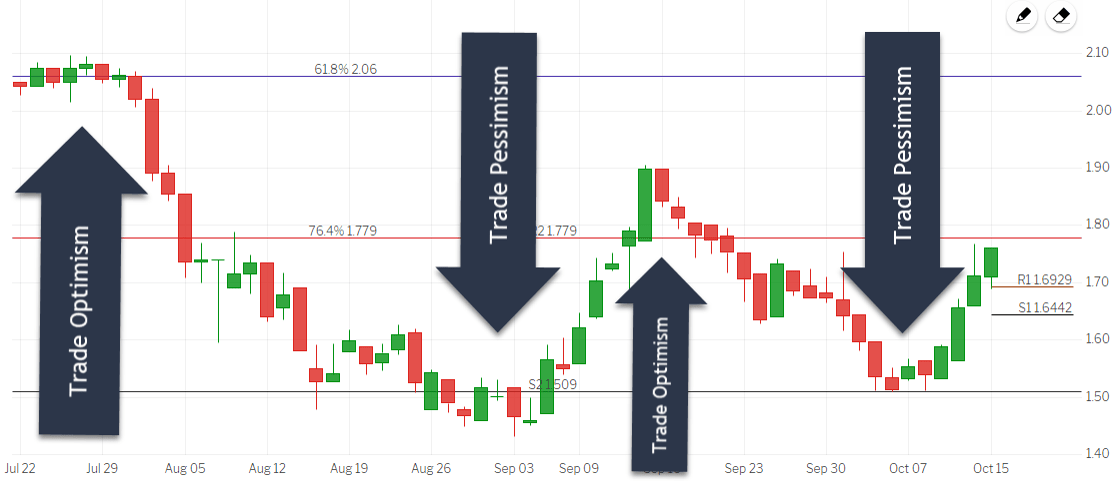

Over the past few months trade negotiators from both countries have engaged in talks to try and resolve differences. The financial markets have monitored the talks closely and sentiment has see-sawed accordingly.

When optimism rises that a trade deal will be reached mortgage rates worsen and when pessimism over a trade deal grows home loan rates tend to improve.

Following last weeks meeting between President Trump and China’s vice premier the financial markets are relatively optimistic that a trade agreement can be reached and therefore interest rates are currently cycling higher.

Will they continue to move higher? Or will optimism wane and help rates cycle back lower? Time will tell.

Brexit

Similarly, news out of Brussels is that UK and European leaders are close to reaching a draft Brexit deal which may allow the UK to separate from the EU in an orderly fashion.

Interest rates in Europe are increasing on optimism over an orderly exit.

The week ahead

Although I expect mortgage rates to react to sentiment over US-China trade talks there are a few other story lines I’ll be following. Third quarter earnings reports have started. As the stockmarket reacts to the reports I expect interest rates to react accordingly (click HERE to learn how the stock market can influence mortgage rates).

Furthermore, we’ll get the latest reads on retail sales (Wednesday), housing starts & building permits (Thursday), and industrial production (Thursday).

I think rates may worsen in the coming days but I do think they will reverse course at some point. For those who can wait I would recommend floating.

Current Outlook: neutral