Think “fake news” is a new phenomenon?

Back in 1935 an organization called the Clark Foundation based in Cooperstown, NY publicized a false story claiming that US Civil War hero Abner Doubleday invented the game of baseball in that town 100 years earlier.

Despite the story being inaccurate it helped the organization raise money to build the baseball hall of fame which inducted its first members on this day in 1936.

Every year around this time baseball fans eagerly await the election results to see which former players will be inducted in that year’s class.

Brexit uncertainty

The financial markets are eagerly awaiting a vote in the British Parliament today which will set the stage for Brexit which is currently scheduled to take place on March 29th.

Britain still does not have an approved trade agreement with the European Union and if Brexit takes place in the absence of one it is likely Britain will fall into recession.

Many analysts are predicting Brexit will get delayed so an agreement can be reached but there is still much uncertainty.

…more uncertainty

Political uncertainty is not contained to Britain. Here in the US we recently reopened the Federal government after the longest shutdown in history. The threat of another shutdown looms three weeks away and it is not a clear that a longer funding bill will get passed in time.

Furthermore, US and Chinese trade negotiators continue to meet periodically but by all accounts are still far from a comprehensive trade deal.

Political and economic uncertainty helps US mortgage rates remain low. Should these issues get resolved I would expect mortgage rates to move higher by .25%-.50%.

Home prices still rising

The Case-Shiller Home Price index report was issued earlier today and showed that home prices nationwide increased by 5.2% from a year earlier. Here in Portland home prices only increased by 4.4% from last year. Many in the media are painting a doomsday scenario.

However, for a customer who puts 5% down on a $400,000 home ($20,000) and sees their home value increase by 4% in the first year (+$16,000) that is better than they could expect from the stock market.

Outlook

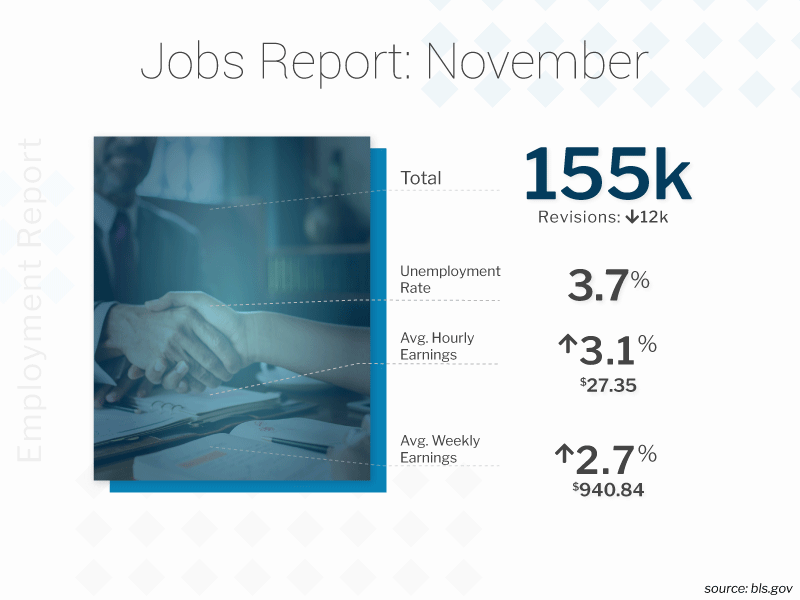

Still to come this week is the Fed monetary policy decision (no rate hike expected) and the all-important jobs report due out on Friday. For now we can continue to float but I am concerned rates may have hit a bottom at current levels.

Current Outlook: floating