Here is a preview of an article I am releasing in an upcoming newsletter to my past clients:

It was Irving Fisher who contributed the equation of exchange to the world of macroeconomics. This equation states that MV=PT, where M= money supply, V= velocity of money, P=price level, and T= quantity of goods and services transacted (real Gross Domestic Product [GDP]).

This relatively obscure equation is the cornerstone of a hotly debated topic in the world of finance these days—namely, whether or not the government’s efforts to stimulate the economy will ultimately lead to acute inflation or not.

Why should you care? Inflation has profound effects on managing one’s personal finances, especially when it comes to managing one’s mortgage. Inflation is the main driver in mortgage rates; when inflation increases, mortgage rates follow suit.

The last time acute inflation struck our economy was in the late 1970s–early 1980s. In 1980, the Consumer Price Index, which is the most widely used measurement of inflation, increased by 13.5% from 1979. At that time, fixed mortgage rates averaged 16.63%.

So why are analysts currently concerned about the future prospect of inflation? Let’s return to Fisher’s equation of exchange. By using simple algebra and solving for price level we get P=MV/T.

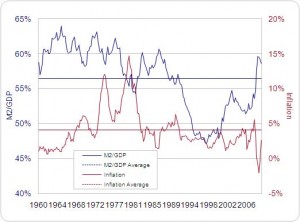

According to Fisher’s equation, inflation rears its ugly head when money supply (M) and/or velocity of money (V) increase faster than GDP. In other words, when there are more dollars in the economy chasing fewer goods, we can expect prices to rise.

Through various programs, the government has flooded our economy with money over the past 12 months with the objective of stabilizing the housing and financial markets. As a result, money supply has increased by 9.0%, according to money stock measures from the Federal Reserve.

There are currently more dollars chasing fewer goods. However, because banks and households have been sitting on their stimulus money instead of lending or spending, inflation has yet to appear, and mortgage rates have remained low.

One side of the inflation debate contends that when the economy cycles back around for the better (pushing V and T higher in the equation), the Fed will not be able to unwind the money supply fast enough to curb inflation.

Arthur B. Laffer is one such alarmist who wrote an opinion piece in the June 11, 2009 Wall Street Journal entitled “Get Ready for Inflation and Higher Interest Rates,” in which he stated, “We can expect rapidly rising prices and much, much higher interest rates over the next four or five years, and a concomitant deleterious impact on output and employment not unlike the late 1970s.”

Others, such as Gus Sauter, managing director and chief investment officer for The Vanguard Group, are not concerned. In a recent letter to investors, he stated, “I don’t think inflation is a foregone conclusion at this point … If the Fed is nimble enough, they may be able to stave off inflation.”

The reality is that we are in uncharted territory. The Fed’s balance sheet has swelled in the past year, and U.S. budget deficits are widening at an alarming rate.

When the economy does recover, these factors suggest we can expect higher inflation and interest rates. Theoretically, the Fed does have the tools to unwind the money supply without major inflationary implications, but I wouldn’t bet my house on it.

If you know you’ll need to manage your mortgage at some point in the next few years, please call us today so we can evaluate your situation and proactively discuss your options with you.