What’s next for rates? It depends on inflation

I’ve written repeatedly on my ‘rate update’ posts that inflation is the primary driver of long-term mortgage rates. When inflation expectations rise mortgage rates follow suit and vice-versa. As I wrote about last September the government’s fiscal stimulus efforts have pumped substantial amounts of money supply onto the Federal Reserve’s balance sheet. According to Irving Fisher’s equation of exchange if that money seeps into our nations money supply we can expect price levels to increase once the economy has rebounded.

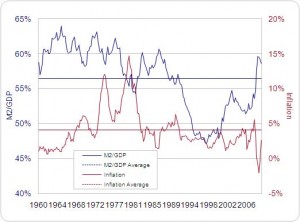

In this months Journal of Financial Planning Joseph Becker takes a different approach. In THIS ARTICLE he looks at the ratio of money supply and GDP (M2/ GDP). His conclusion is somewhat alarming:

Figure 2 indicates that after peaking in 1965, M2/GDP began a 30-year downward trend that bottomed in 1997. Since then, M2/GDP has been on an upward trend that accelerated during the difficult economic environment of 2008 and 2009. It is interesting to note that in 2009, the gap between M2/GDP and the rate of inflation reached 61 percent. The only time during the previous 50 years that it was higher than 61 percent was in the early 1960s, a period that was followed by 15 years of significant inflation.

If he’s right, then many of the inflation hawks might be right. Today’s fiscal stimulus could turn into tomorrow’s hyper-inflation and therefore higher mortgage rates.

If he’s right, then many of the inflation hawks might be right. Today’s fiscal stimulus could turn into tomorrow’s hyper-inflation and therefore higher mortgage rates.