Mortgage Rate Update January 12, 2017

Although mortgage note rates are unchanged today the accompanying closing costs are modestly lower so in fact the rate environment has improved slightly this week.

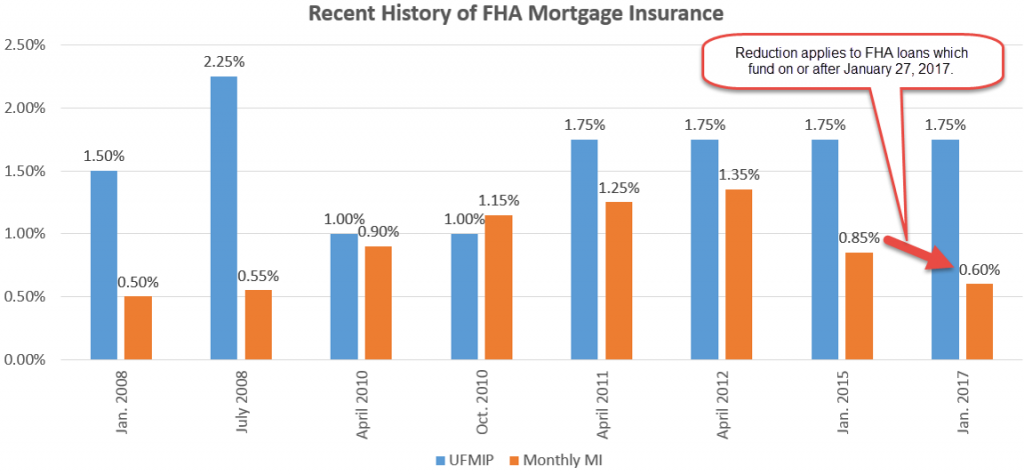

In case you missed it FHA announced Monday that FHA mortgage insurance premiums will be reduced beginning January 27, 2017. If you ever work with FHA buyers then I would encourage you to read the details HERE.

Improved mortgage rates and lower FHA mortgage insurance premiums should help improve affordability but as we know affordability has eroded significantly in recent years. Has housing reached an inflection point? Read about and share your thoughts on the topic HERE.

Beginning in late November and again in mid-December I wrote that I thought the financial markets had overreacted to the results of the election. It took longer than I hoped but it finally looks like the markets are reversing course. I do not expect mortgage rates to drop to levels seen prior to the election but they have improved by .125%-.25% over the past couple weeks. Let’s be thankful for that.

From a technical perspective momentum is on our side so I will maintain a floating position. That said, if you have been floating for the past couple weeks it may not be a bad plan to lock in and take your profits off the table.

Current Outlook: floating