Mortgage Rate Update December 8, 2016

Mortgage rates are modestly improved from Monday. Pricing on mortgage rates improved the first three days of this week but have actually given a little back this morning.

The big news impacting the financial markets this morning is an announcement from the European Central Bank (ECB). ECB President Mario Draghi stated that they would maintain their bond buying program to help support low interest rates in Europe but that they would scale back the volume of the purchases. Initially interest rates here in the US moved higher on the announcement.

US stocks continue to trade at or near all-time highs. When stocks do well mortgage rates tend to suffer.

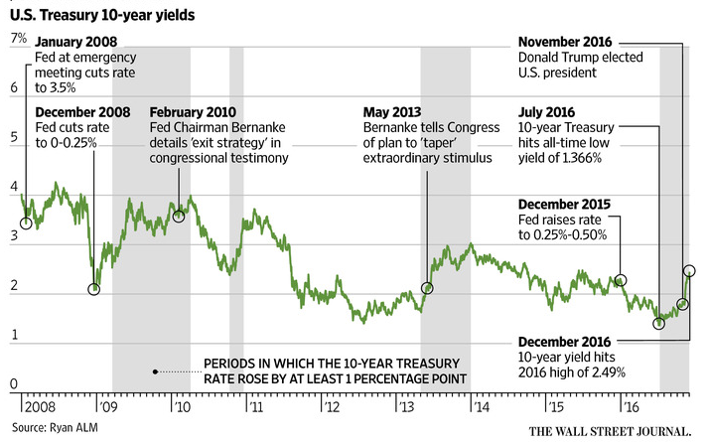

As I have been stating since the end of November it is my opinion that US interest rates have overreacted to the results of the election. History also supports this view. The Wall Street Journal ran a graph showing the last few times that the yield on the US 10-yr treasury note have increased acutely.

Each time yields eventually stabilized and reversed lower. There is no guarantee this will happen again. Furthermore, if rates do improve from current levels I do not expect them to move all the way back to where they were prior to the election. But, I do believe with time rates will move .125%-.25% lower. I wish I knew when!

Current Outlook: floating