Mortgage Rate Update June 9, 2014

Mortgage rates are about even since last Thursday’s ‘rate update’. You may recall that update focused on the impact that economic weakness in Europe is having on mortgage rates. The WSJ published THIS PIECE on Sunday echoing the same point.

In case you missed it Friday’s all-important jobs report came in near expectations at 217,000 new jobs. Mortgage rates did not react much to the news.

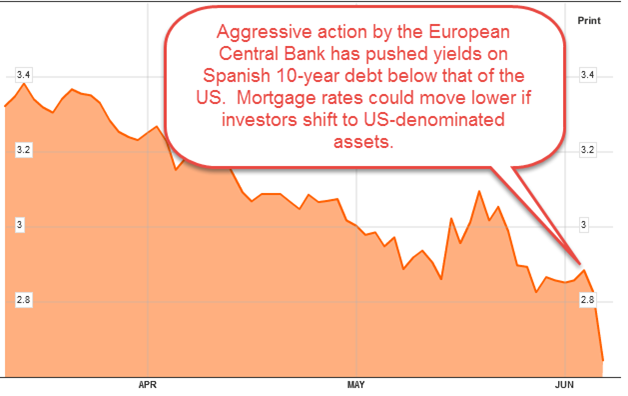

It’s amazing how quickly the financial markets can about face. Does anyone remember the European Debt Crisis which almost collapsed the financial systems of Greece, Italy, Portugal, Spain, and Ireland? In July of 2012 investors demanded a yield of ~7.6% on Spanish 10-year notes. Believe it or not the yield on the Spanish 10-year note (2.62%) is now lower than the the yield on the US 10-year note (2.63%). This means investors see less risk in the Spanish Government’s ability repay its debt obligations versus the US. Huh?

The economic calendar is light this week so mortgage rates will likely react to international news and technical trading patterns. Currently, mortgage rates are about .125% higher than the 11-month lows achieved at the end of May. For now we can float but we have to be careful because we do expect rates to trend higher at some point.

Current Outlook: floating