Home loan rates remain flat, risk of break out build

It all started with $6,000 in February of 1940 when the US Government granted that sum to a group of researchers who were curious about the potential for fissionable materials to be used for military purposes. The original $6,000 later ballooned to over $2 billion and on this day in 1945 the Manhattan Project first “successfully” tested the atom bomb.

Home Loan Rates

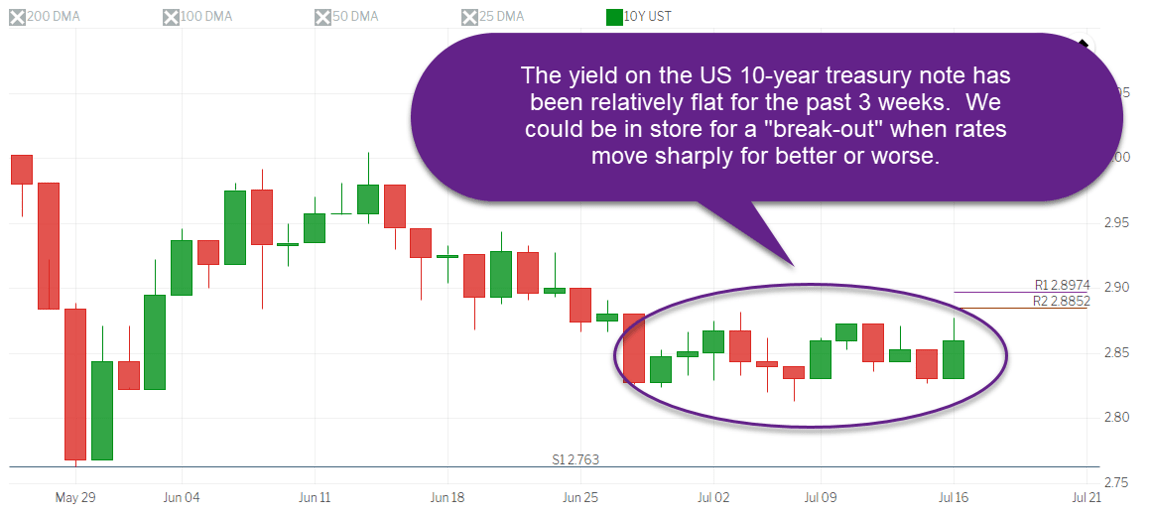

Mortgage rates have been anything but explosive over the past two weeks. Home loan rates have remained flat over that timeline.

Inflation

Price pressure is the primary driver of long-term interest rates.

Last week both the Producer Price Index and the Consumer Price Index showed price increases above the Fed’s target of 2.0%. The reports lend credibility for the Fed to maintain its rate tightening policy. It also increases the probability that mortgage rates will increase and not decrease.

Retail Sales

Although consumers may be paying higher prices for goods it does not seem to be slowing sales. This morning the retail sales report showed better than expected activity. Many analysts are pointing to federal income tax cuts as the primary reason why.

Good news for the economy tends to be bad news for mortgage rates.

The Week Ahead

The economic calendar is fairly light this week. Fed Chairman Jay Powell will be speaking on Tuesday. On Wednesday we’ll get a look at housing starts and building permits. On Thursday we’ll get leading economic indicators.

Technical signals

Mortgage rates have remained relatively flat for almost three weeks. Any time rates remain flat for extended periods of time it increases the chances of a “break-out” which is when they move sharply higher or lower. There is no telling when they will “break” and if they will break in our favor. The safe play is to lock in but ultimately it is a coin flip.

Current Outlook: neutral