Mortgage rates at best level since April, time to lock

On this day in 1846 the United States captured a small settlement called Yerba Buena located in a bay. This site is now home to one of the most expensive housing markets in the world. SEE HERE for a parody on some of the rental offerings in this city which was later named San Francisco.

Home Loan Rates

Mortgage note rates remained unchanged last week although the underlying closing costs improved modestly. Pricing on mortgage rates are at the best levels since April.

Jobs

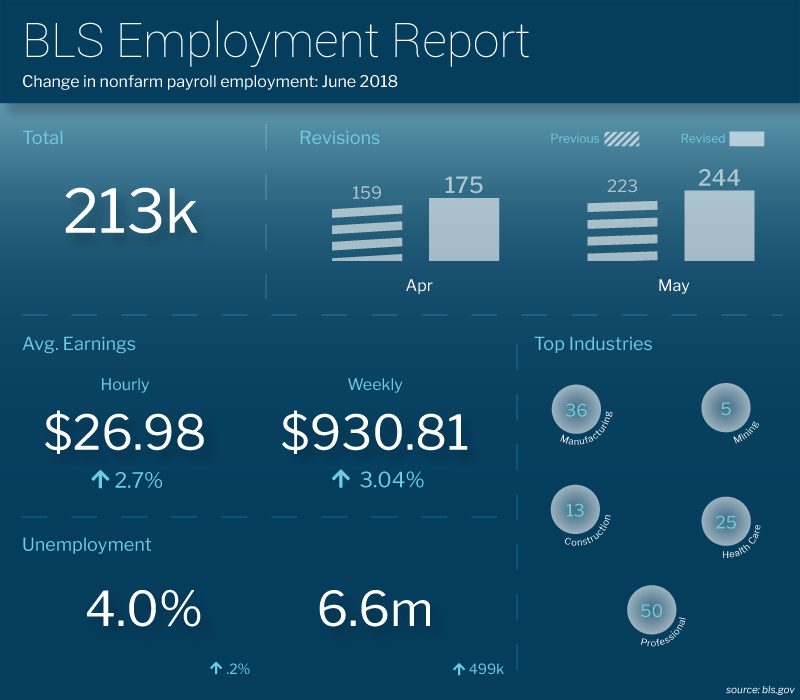

Last Friday’s all-important jobs report is being referred to as “goldilocks”, not too hot and not too cold. It showed 213,000 new jobs created during the month of June and the US unemployment rate at 4.0%. Wages increased moderately.

Overall, it was a healthy report but not too healthy to stoke inflation fears and push mortgage rates higher.

The Week Ahead

There are not a lot of economic releases scheduled for this week but there will be some key events. On Wednesday we’ll get the Producer Price Index, which reports on prices at the wholesale level of our economy, and on Thursday we’ll get the Consumer Price Index, which reports on prices at the retail level.

Inflation is the primary driver of long-term interest rates including mortgages. Inflation has been ticking higher but not enough to pressure rates too badly. Any signal that inflation is accelerating would be bad for home loan rates.

The US Treasury is set to deliver $69 billion in fresh debt supply this week. This is 23% more than was offered last year at this time. The extra debt is being issued to fund the federal income tax cuts. The additional debt supply will make it harder for mortgage rates to improve.

After improving over the past couple weeks I think interest rates are ripe for reversal. I am going to recommend a locking position.

Current Outlook: locking