Mortgage rates are unchanged from last week.

Let’s start off the week with some housing news. The National Association of Realtors released its existing home sales for October. The headline number of existing home sales fell from September but remains ~4% above October 2014. Within the report there are some interesting details.

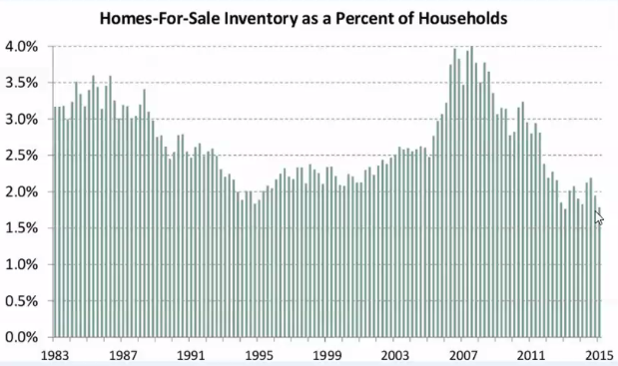

The inventory level for homes remains tight. As a percentage of US households only 1.75% of the housing stock is currently available for sale. This is well below the historic average of ~2.6%. A tight supply is one main reason why prices continue to rise. Speaking of prices rising, the median home price in the Western Region increased by 8% from a year ago.

First time homebuyers accounted for 31% of all purchases, up from 29% in September. Conversely, the number of distressed sales (foreclosure or short sale) declined and currently are 9% below October 2014.

The remainder of this compact work week is jammed with significant economic data. Tomorrow we’ll get the second estimate for third quarter GDP and the latest S&P Case Shiller Home Price Index report. On Wednesday we’ll get personal income, personal consumption expenditure price index, the FHFA home price index, durable goods, and new home sales. Needless to say we could see volatility for the remainder of the week especially since many trading desks will likely be vacant on Wednesday.

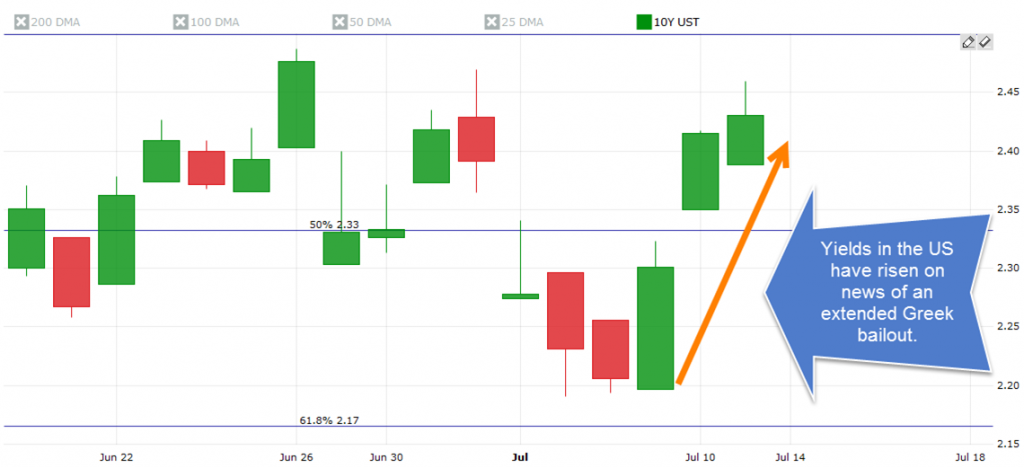

From a technical perspective mortgage rates are trading near important technical levels. We will want to keep an eye on the US 10-year treasury yield this week. It is currently trading at 2.27%. Should it pierce above 2.33% I will shift to a locking position.

Current Outlook: floating as long as the US 10-year treasury is at or below 2.33%.