Mortgage Rate Update July 13, 2015

Mortgage rates are slightly higher across the board this morning on news that Greece and its creditors have reached a bailout agreement.

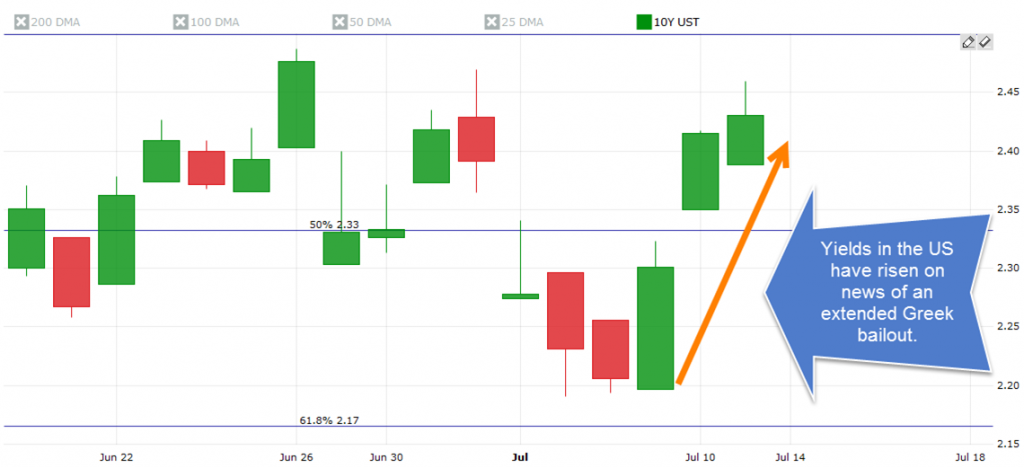

Earlier today it was announced that Greece has agreed to terms for an €86 billion bailout. Greece will have to implement a series of austerity measures which will be tricky given that last Sunday Greek citizens voted down a referendum with similar terms. For now, interest rates in the US have risen on the news given that there is less fear and uncertainty surrounding the situation.

The yield on the US 10-year treasury note has risen to ~2.45%, up from only ~2.2% at the beginning of last week. Mortgage rates tend to change along with the US 10-year treasury note.

The economic calendar is very busy this week. The highlights include Retail Sales (Tuesday), Producer Price Index (Wednesday), Consumer Price Index (Friday), and congressional testimony from Fed Chairwoman Janet Yellen.

From a technical perspective interest rates are presently at the higher end of the trading range they’ve been bound in for the past month or so. Assuming these technical levels hold we would recommend floating. However, with a Greek bailout deal in place we run the risk of rates moving higher.

Current Outlook: cautiously floating