Yield on US 10-year treasury note holds key to direction of mortgage rates

Housekeeping: This weekly ‘rate update’ email will now be delivered each Tuesday instead of Monday.

You may be here today but will you be gone to Maui? On this day in 1959 Hawaii became the 50th state of the union. I plan to celebrate when I am on Kauai in January.

Mortgage Rates

Home loan rates improved modestly last week. That said, during the month of August mortgage rates have barely budged.

Housing

Those of in the real estate industry are acknowledging a modest slowdown in activity. My personal view is that 2018 is the first year since 2014 for where we experience seasonality with demand.

Last week the Commerce Department reported that permits for single family homes decreased by 10% in the western region. It appears that builders are having a harder time finding affordable and sufficient skilled labor.

This week the National Association of Realtors will release date on existing home sales on Wednesday and new home sales on Thursday.

Aside from that the only significant economic event on the calendar is durable goods which is also due out on Thursday.

Technical Trading Patterns

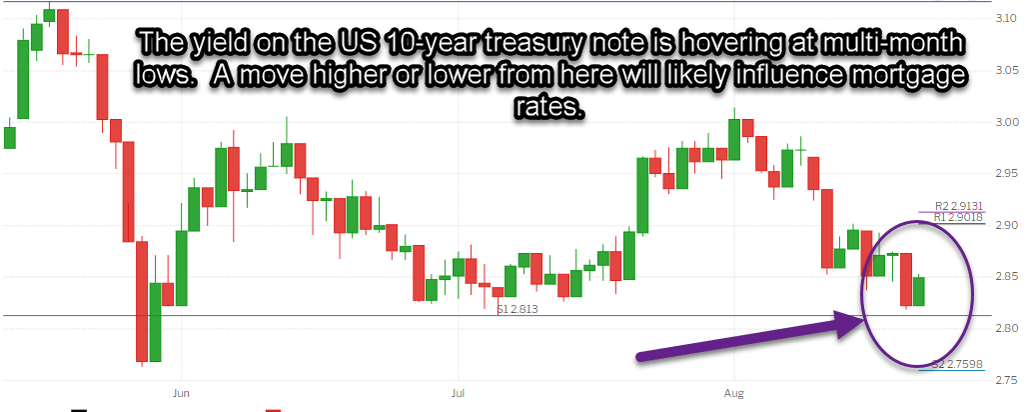

In the absence of a lot of economic data I expect mortgage rates to react to the stock market (when stocks do well mortgage rates tend to suffer and vice versa) and technical trading patterns.

The yield on the US 10-year treasury note, which home loan rates tend to track, is currently trading at 2.85%. This is as good as interest rates have been all summer.

If yields can find a way to break below 2.82% then we could see home loan rates improve by another .125%-.25%. However, the past couple times that yields have hit this point they have reversed higher and home loan rates have worsened by .125%.

Current Outlook: cautiously floating