Weakness in stocks is helping home loan rates remain low

Home Loan Rates

Although mortgage note rates are unchanged from last week the associated closing costs are slightly lower so in fact the rate environment has improved.

Stocks and home loan rates

Weakness in the stock market is helping mortgage rates improve. Why are stocks suffering?

Virus in China

Over 300 people in China and Taiwan have been infected with the coronavirus which health officials fear could spread into a pandemic. The outbreak is happening just before the lunar new year when over 400 million Chinese citizens are expected to travel.

The health scare is causing a flight-to-safety in the Asian financial markets. The Hong Kong stock index was down ~3% today which is creating demand for US-based fixed-income securities and driving down yields.

Stock Valuations

Citigroup conducts a statistical model which measures stock market sentiment. As of today the model has reached a level they define as “Euphoira”. 80% of the time when this model reaches this level stock prices are lower 12 months later. Furthermore, the last time this model hit this level was April of 2019 and stocks declined 7% the following month.

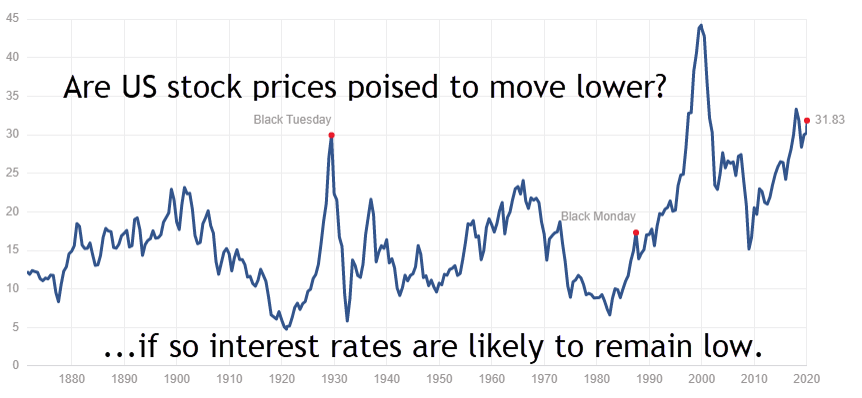

Furthermore, the Shiller Cyclically Adjusted Price to Earnings Ratio is currently back above 30 for the first time since 2018. Prior to 2018 the only other times stock valuations had reached this lofty level was 1929 and 1999.

Should stock prices retreat it will likely help mortgage rates remain low.

The week ahead

This week’s economic calendar is light. The only significant highlight is the existing home sales report due out on Wednesday.

Momentum appears to be on our side so I will recommend a floating position.

Current Outlook: floating