US 10-year treasury note dips below 2.00%, mortgage rates improve

The fourth of July is right around the corner which means it’s time to start looking for the best place to buy fireworks. Some people look for the lowest prices but as my friend Rob Chrisman advises the best fireworks can be found where the salesperson has three fingers and an eye patch.

Interest Rates

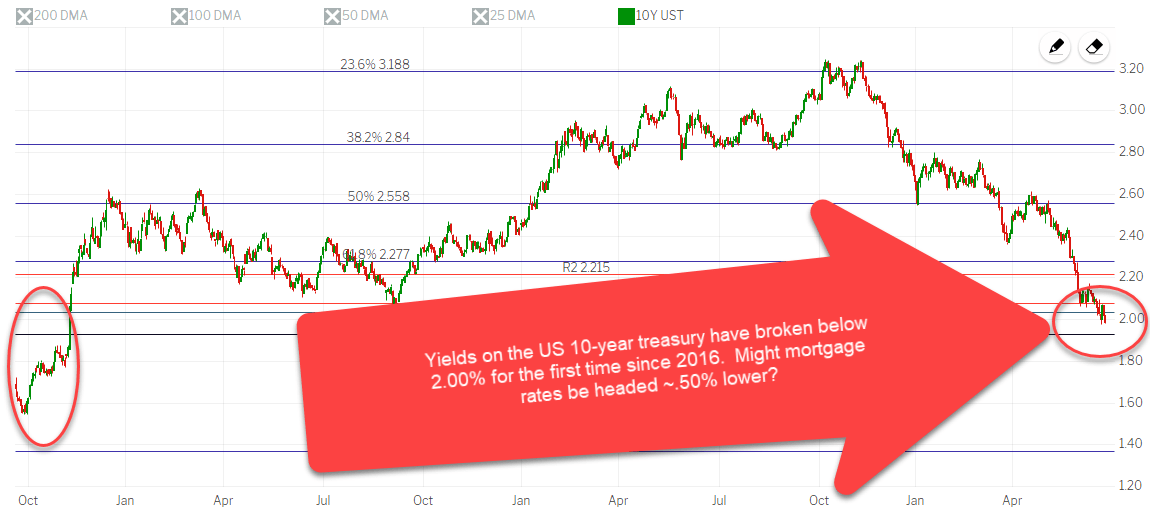

Interest rates around the globe continue to trend lower. The yield on the US 10-year treasury note, which mortgage rates tend to track, has pierced below 2.00% for the first time since 2016.

What’s this mean for mortgage rates?

Home loan rates are currently at the lowest levels since 2017 based on the US 10-year treasury note hovering around 2.00%. If the US 10-year treasury dips down to the lows of 2016 (~1.4%) then we could see mortgage rates improve by another .50%.

There is no guarantee that this will take place but momentum appears to be on our side.

Home Prices

The S&P CoreLogic Case-Shiller home price index for April was released earlier today and showed that home price appreciation nationwide was +2.5% year-over-year. Here in Portland home prices grew by +2.6% which was unchanged from the month before.

I suspect home price appreciation may pick up a little in May and June given that interest rates have improved significantly since April.

The Week Ahead

Later today Fed Chairman Jerome Powell is scheduled to speak.

At the beginning of the year the financial markets were predicting the Fed would hike short-term interest rates twice during 2019. Now expectations are that the Fed may cut rates twice. Chairman Powell’s comments will be closely watched in the coming weeks.

On Thursday we’ll get the latest reading on pending home sales and ono Friday we’ll get the Fed’s favorite gauge of inflation (PCE).

Given that momentum is still on our side I will maintain a floating position.

Current Outlook: floating bias