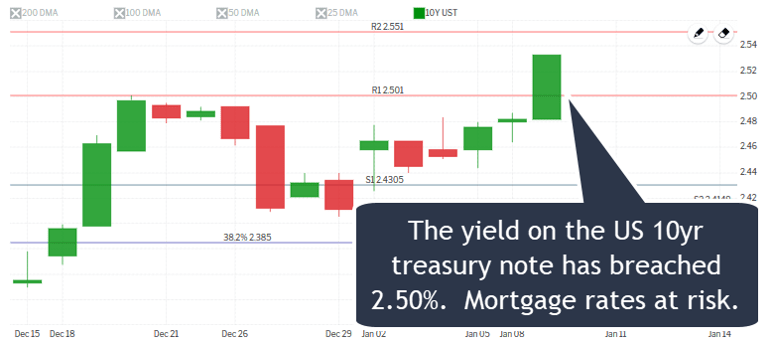

US 10-year treasury breaks 2.50%, mortgage rates at risk of moving higher

I warned in yesterday’s post (see HERE) that, “if the yield on the US 10-year treasury note breaks through 2.50% then watch out. I would expect mortgage rates to worsen by another .125%-.25%.”

This morning yields have broken above 2.50% which is not a favorable sign for home loan rates.

There are a variety of factors contributing to the move higher in rates including an expectation for less monetary stimulus in Japan and Europe, growing inflationary pressure, and economic optimism.

It is possible that yields reverse and move back below 2.50% but if that does not happen today and the market closes above this threshold then it will be more difficult for that take place in the near-term.

At this point I would recommend loan applicants lock their rates (if they are able) if they haven’t already.