Rates modestly worse but long-term trend in tact

Congratulations to the US Women’s soccer team who capped a dominating performance on Sunday by winning the World Cup. The US recorded 26 goals during their seven games in the World Cup and only gave up 3!

Interest Rates

Mortgage rates are modestly worse to start the week after the Bureau of Labor Statistics released a stronger than expected employment report on Friday.

Jobs Report

The all-important jobs report showed that 224,000 new jobs were created during the month of June and eased recession concerns. Yields increased modestly following the release.

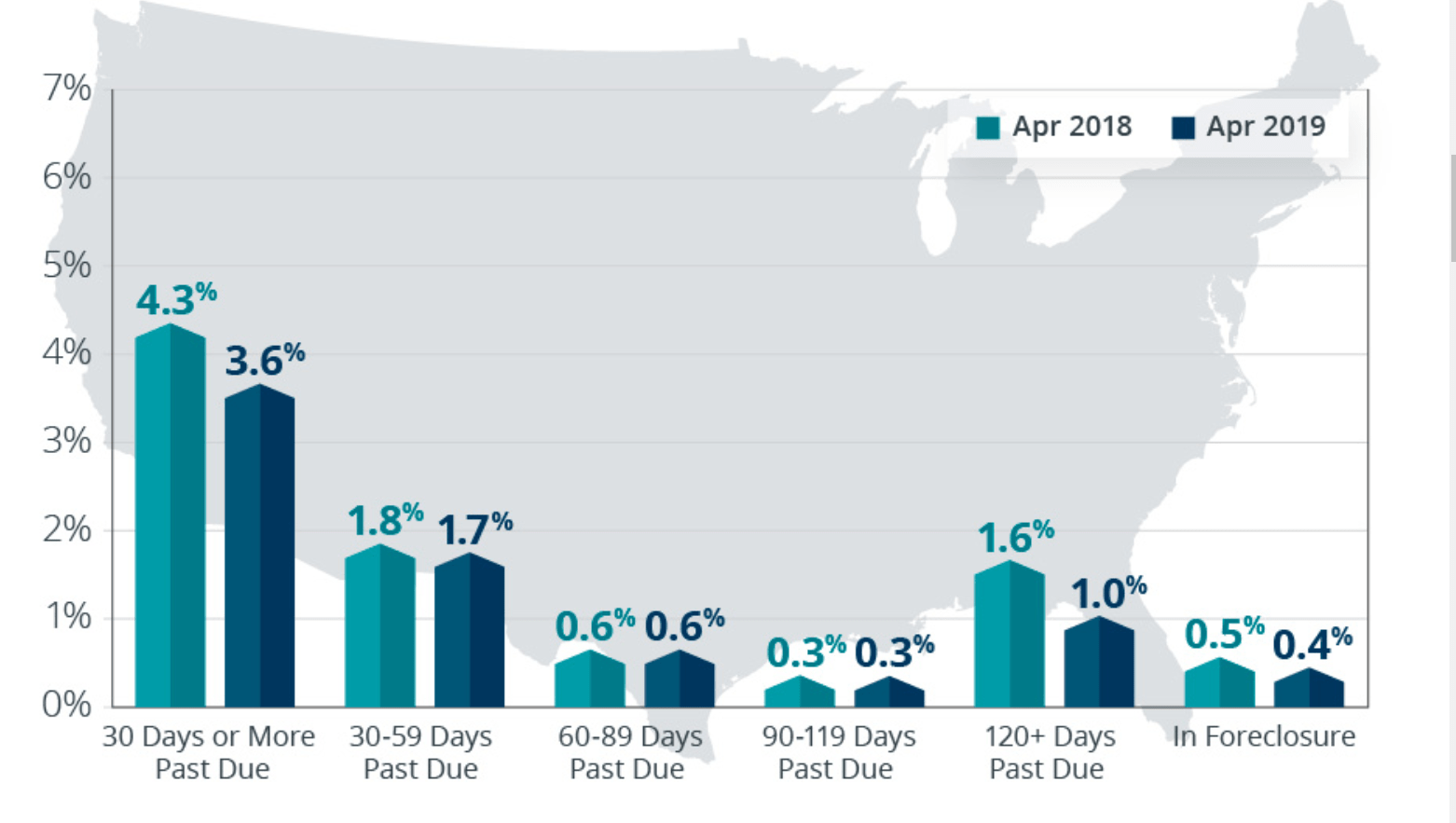

Home Loan Performance

A strong labor market and healthy home price appreciation is creating conditions for low delinquency. CoreLogic’s monthly Home Loan Performance Insights Report was released earlier today and shows delinquency is currently at a 20-year low across the US! It’s hard to imagine a housing crash is on the horizon given that statistic.

The Fed Speaks

Fed Chairman Jerome Powell is scheduled to speak Wednesday and Thursday this week. The Fed’s Open Market Committee is scheduled to meet July 31st and there is currently only a 5% probability that the Fed will cut rates at that time (the markets assign a 60% chance of a cut at the Sept. 18th meeting).

The minutes from the last Fed meeting are also scheduled to be released on Wednesday. Should his comments or the minutes alter the outlook for a rate cut it could cause some volatility in the financial markets.

The rest of the week

Aside from Fed speak we’ll be watching the Consumer Price Index scheduled for release on Thursday and the Producer Price Index on Friday. Hotter than expected inflation could put upward pressure on rates.

The long-term trend remains in our favor so will remain in a floating stance.

Current Outlook: floating