Mortgage Rate Update October 10, 2017

The bond markets were closed yesterday in observance of Columbus Day. According to historians Christopher Columbus was not the first European to sail across the Atlantic Ocean. Norse Viking Leif Eriksson allegedly reached present day New Foundland, Canada in 1000 AD.

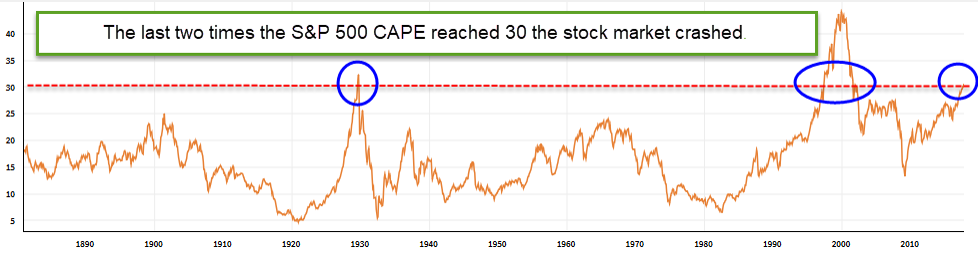

If you are an observer of the stock market then you know that this is not the first time that the S&P 500 has reached 30 as measured by its cyclically adjusted price earnings ratio (CAPE). The concern is the last two times it sailed to these heights was 1929 and 1999 and we all know how that ended.

The Economist Magazine ran a great piece over the weekend (see HERE) addressing asset prices. It provides explanations for why the CAPE is at lofty levels and why it may not translate into a crash. However, in the same article they provide reasons for why interest rates may rise. The main culprit? As I have written repeatedly on this blog it is expected to be the Fed unwinding its balance sheet.

Speaking of the Fed the financial markets are currently pricing in a 90% probability that they will hike short-term interest rates in December.

Last week’s jobs report was a stinker. The US economy shaved 33,000 jobs during the month of September but investors are ignoring the results because of the hurricanes.

The highlights for the economic calendar this week include the producer price index on Wednesday and retail sales/ consumer price index on Thursday. Momentum is not on our side so I will maintain a locking bias.

Current Outlook: locking